Upozorenje na rizike: Financijski ugovori za razliku (CFD) složeni su instrumenti i povezani su s visokim rizikom brzih financijskih gubitaka zbog poluge. Na 76.44% računa malih ulagača dolazi do financijskih gubitaka pri trgovanju CFD-ovima s ovim pružateljem. Trebali biste razmotriti razumijete li kako CFD-ovi funkcioniraju i možete li si priuštiti visoki rizik financijskih gubitaka. Molimo pročitajte Obavijest o rizicima.

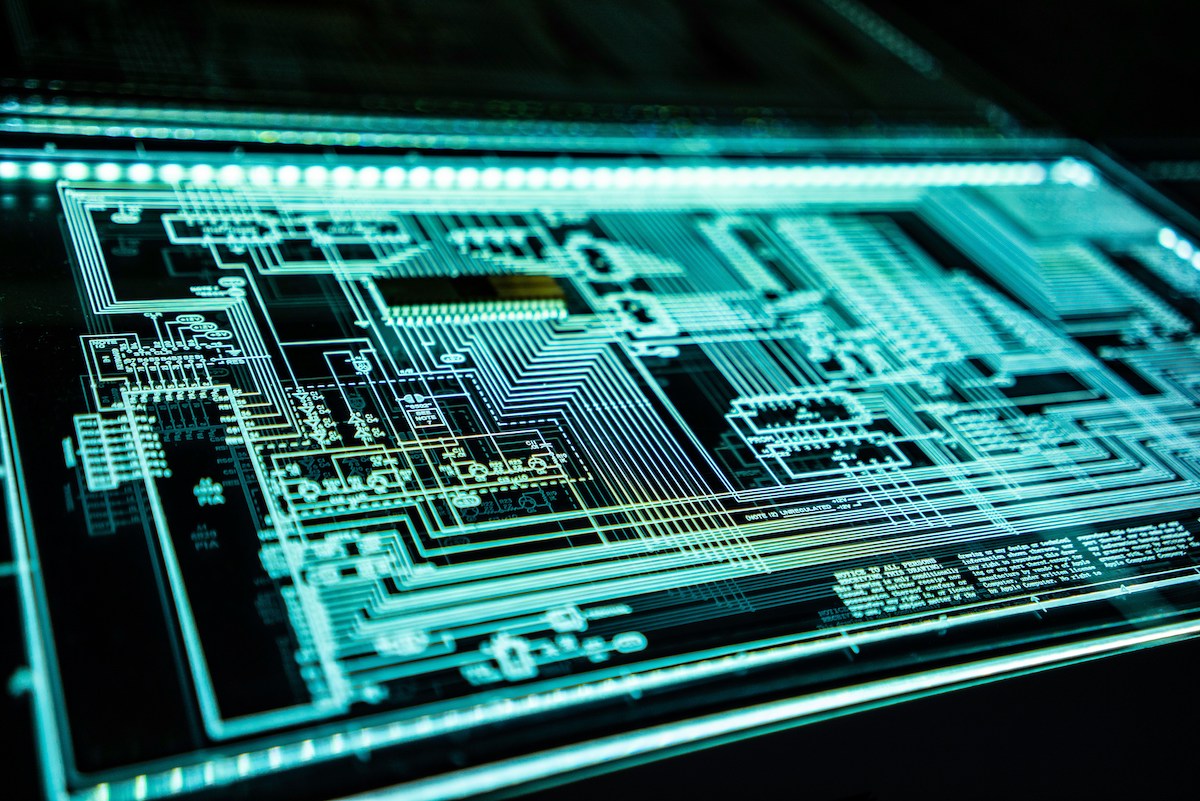

Chipmaker TSMC raises billions to expand its operations

Headquartered in Hsinchu, Taiwan, TSMC specialises in the production of integrated circuits that have a wide range of applications in consumer electronics, telecommunications, automotive and many other industries. TSMC's cutting-edge technology and manufacturing capabilities have made it a key player in the global semiconductor industry. By the end of 2023, the company had a 61.2% share of the semiconductor market[1]and their chips are used in product components from many technology giants such as NVIDIA, AMD, Microsoft, Alphabet and many others. This global presence enables TSMC to play a key role in the global AI revolution and other technology trends.

U.S. government investment

The Biden administration will provide TSMC with $6.6 billion in subsidies and another $5 billion in loans to help finance the construction of three factories in Arizona, USA. In addition to the government funding, TSMC plans to invest more than USD 65 billion in its Arizona operations, and in particular the third factory. Although the manufacturer expects some labour issues, it plans to create thousands of permanent jobs and tens of thousands of temporary jobs as part of the construction of the new factories, with the first one expected to begin production in the first half of 2025. The project represents the largest foreign direct investment in Arizona's history, and is expected to produce more advanced chips than are currently on the market. At the same time, according to a White House statement, the project is expected to be a major boon to the US economy and strengthen the US position in semiconductor manufacturing.

The Biden administration will provide TSMC with US$6.6 billion in subsidies and an additional US$5 billion in loans to help fund the construction of three factories in Arizona, USA. In addition to government funding, TSMC plans to invest more than USD 65 billion in its Arizona operations and in particular in the third factory. Although the manufacturer expects some labour challenges, it plans to create thousands of permanent jobs and tens of thousands of temporary jobs as part of the construction of the new factories, with the first one expected to start production in the first half of 2025. The project represents the largest foreign direct investment in Arizona's history, with the hope of producing more advanced chips than are currently on the market. At the same time, according to a White House statement, the project is expected to be a major boon to the US economy and strengthen the US position in semiconductor manufacturing.

The grant is part of the Biden administration's efforts to revitalise the advanced semiconductor manufacturing process on US soil. The goal is to support and secure chip supply chains that are vital to the economy and national security. Their fragility was demonstrated, for example, during the Covid-19 pandemic, when these chains collapsed due to constraints, followed by a global chip crisis that affected a number of industries and set off a chain reaction.[2][3]

An initiative of global proportions

The United States is not alone in trying to ensure stable supply chains. TSMC decided to build a plant in Kikuyo, Japan, to create a key location for the Asian semiconductor supply chain. It opened its first factory there in February, which is also its first plant outside Taiwan since 2018. Japanese technology companies such as Sony and Toyota are among TSMC's major customers with huge investments in this newly opened branch.[4]

In addition, the chipmaker last year announced an investment to open its first factory in Europe, which will be located in Germany. TSMC has earmarked €3.5 billion ($3.8 billion) for the project, while the German government has pledged a €5 billion ($5.4 billion) contribution. The European Union has committed to doubling its chip manufacturing capacity by 2030 through the European Chips Act initiative, with the aim of reducing its dependence on non-EU suppliers and moving closer to the capacities of Asia or the U.S.[5]

Spolupráca s Microchip Technology

TSMC, through its Japanese subsidiary JASM, is starting a collaboration with Microchip Technology, which has supported the creation of 40-nanometer chip production capacity in Japan. The move will enable better supply of chips to various industries in the local market and ensure the resilience and diversification of production capacity. According to Michael Finley, Microchip's vice president of manufacturing and technology, expanding the collaboration with TSMC is an important strategic move to strengthen customer confidence in Microchip Technology products.[6]

Economic results

In the fourth quarter of 2023, the company had stable revenues of $19.62 billion, up 14.4% from the third quarter, but net income of $7.4 billion marked a 19.3% year-over-year decline. Gross margin was 53%, with shipments of 3-nanometer chips accounting for 15% of total sales. For 2023, sales were $69.3 billion, down 4.5% from the previous year, and net profit was $26.85 billion, with a 17.6% year-on-year decline.[7] TSMC reported a 34% increase in March 2024 sales from last year, reaching $6.04 billion. In the first quarter, sales reached $18.35 billion, up 16.5%, driven in large part by an increase in demand for AI chips. [8] [1]

TSMC's stock price development over the last 5 years. (Source: Google Finance)*

Conclusion

The drive by world governments to expand chip production into their territories marks a historic shift in terms of diversifying supply chains and increasing security of supply in a key industry, which is critical in the context of previous outages. In addition, it shows that TSMC, as a leading player in the semiconductor industry, is not afraid to invest and expand its operations to more parts of the world, strengthening its global presence and ensuring a steadily growing demand for its products. Despite some economic fluctuations, TSMC maintains its leading position in the industry.

Adam Austera, Chief Analyst at Ozios

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which may change. Such statements are not guarantees of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.

[*] Past performance is not a guarantee of future results

[1] Top semiconductor foundries market share 2023 | Statista

[2] TSMC gets $6.6 billion in chipmaking cash from Biden while pledging to build a third Arizona plant (yahoo.com)

TSMC: Biden to give Taiwanese company $6.6 billion to ramp up US chip production | CNN Business

[3] TSMC: Biden to give Taiwanese company $6.6 billion to ramp up US chip production | CNN Business

[4] How Japan Is Trying to Rebuild Its Chip Industry - The New York Times (nytimes.com)

[5] Germany spends big to win $11 billion TSMC chip plant | Reuters

[6] Microchip expands TSMC partnership for resilient supply By Investing.com