Upozorenje na rizike: Financijski ugovori za razliku (CFD) složeni su instrumenti i povezani su s visokim rizikom brzih financijskih gubitaka zbog poluge. Na 72.76% računa malih ulagača dolazi do financijskih gubitaka pri trgovanju CFD-ovima s ovim pružateljem. Trebali biste razmotriti razumijete li kako CFD-ovi funkcioniraju i možete li si priuštiti visoki rizik financijskih gubitaka. Molimo pročitajte Obavijest o rizicima.

Is It the Right Time to Invest in Stocks?

In the past 100 years, the world has witnessed close to 15 years of recessions & downturns, characterized by wounding inflationary pressures, underwhelming business performance and pale investor sentiment which deteriorated economies.

Typically, with recessions come winners as we’ve seen in the recent COVID-19 epidemic. Video conference hero Zoom and e-commerce giant Amazon capitalized on the rising demand for consumer products and the vulnerability of corporations necessitating business to go on.

This year, things are a bit different. 2022 was infamous for its tedious viciousness. From real estate to commodities & stocks, financial products have seen the darker side of sentiment amid growing pessimism and short-lived rallies.

The Federal Reserve was quick to combat red-hot inflation by adopting a hawkish stance; it hiked interest rates like no tomorrow. One raise after the other, interest rates now nest between 3.75% to 4.00% as of its latest meeting. The S&P 500 index, which is regarded as a benchmark for global performance, slashed a quarter of its value this year but eventually revitalized nearly 12% from its October lows.*

This may be an indication that now’s the time to invest in stocks. But, do note that 2020’s bearish market which ended the reign of the bullish run since 2009 still plagues the economy across the majority of industries to this day. Is the COVID effect still here? Or has it perished?

The COVID Effect

Before the 2022 bear market took its toll, the 2020 COVID pandemic struck the global economy. An official declaration of a global pandemic by the World Health Organization (WHO) signaled the start of yet another recession. Fortunately, markets recovered in just 33 days and the recession was trailed by a stock market boom in the summer & fall of the same year.

The speedy market rejuvenation came as result of a hawkish Federal Reserve rapidly passing multiple bills to stimulate the U.S. economy, which reciprocated to other nations around the world, and in-turn, heightening investor confidence amid vaccine development & widespread.

The following year was incredible for the markets, scoring impressive numbers despite political downturns, disrupted supply chains and the birth of record-high inflationary cycles, with inflation at the United States peaking at 7% in December.

The past couple years collectively felt like one jumble of events, and has brought about a newfangled, prolonged recession. Investors, consumers, businesses and even nations presumed that they’ve escaped the pandemic turmoil unscathed, yet, past problems crept out more agonizing than ever.

The Bear Market of 2022

Since the start of the year, macropolitical unrest enkindled by Russia’s invasion on Ukraine swayed investors away from dollar-backed assets. After the United States and its allies, notably Germany, imposed energy-focused sanctions on Russia, oil supplies diminished and the price of crude barrels soared.

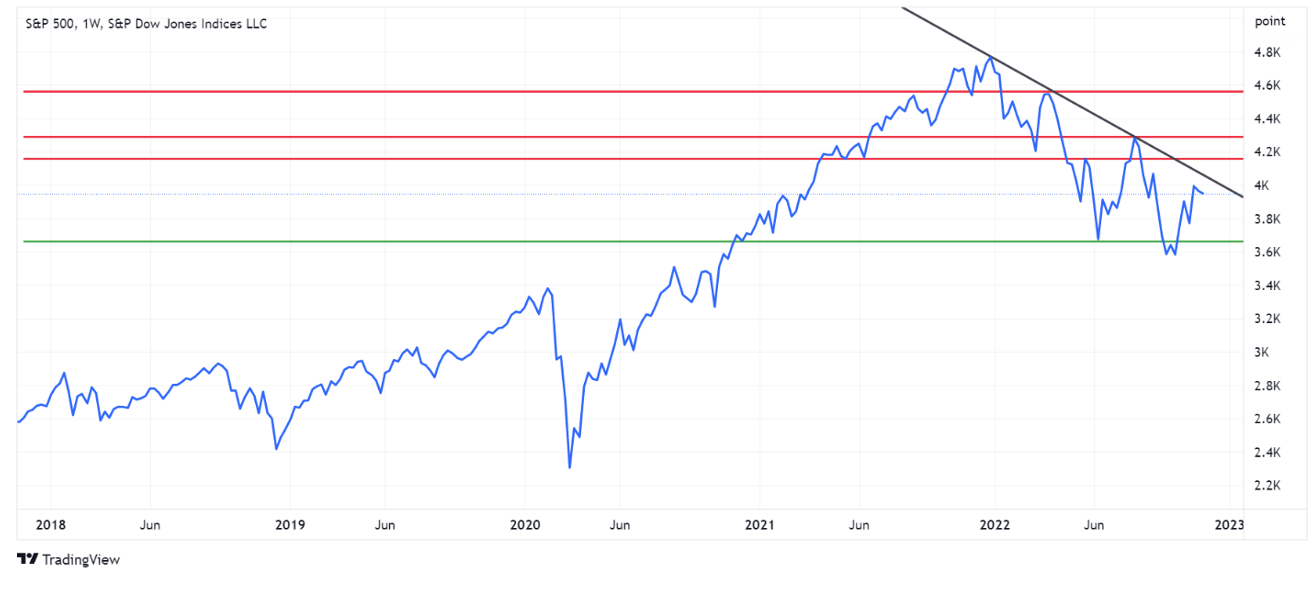

Performance of S&P 500 index over 5 years. Source: tradingview.com

As seen in the TradingView chart above, the S&P 500 endured hardship in 2022. The support level near 3.7k points resembles a cushion which if surpassed, might be an indication that the ferocious decline isn’t over.[1] Despite that, it can be seen that there is some slight recovery, totaling the year-to-date drop to 16%.*

The Dow Jones index edged 7% lower, while the tech-savvy Nasdaq was among the hardest hit, falling close to 30% since the start of the year.* Technology stocks suffered the consequences of deepening semiconductor supply shortages, as well as rising COVID cases in China; the international hub for manufacturing.

Hand-in-hand with growing concerns of an imminent recession, global inflation ensued and the Federal Reserve adopted an aggressive & hawkish stance in raising interest rates. Other central banks which were historically reluctant to follow-suit, such as the European Central Bank (ECB), also hiked their rates to retaliate against record-high inflation.

Are We Out of the Woods Yet?

There's no doubt that markets crashed in 2022, evident in the red-hot inflation, omnipresent economic hardship & reluctancy to engage in moneymaking activities. Whereas last year’s inflation peaked at 7%, this year’s rates make that high look like child’s play, peaking at 9.1% in June, while ironically, the lowest inflation recorded this year surpasses last year’s highs.

The golden question: Is it the right time to invest in stocks?

The golden answer: To quote Doris Day, perhaps!

Given current market circumstances, it can be a great time for investment. An optimist might see this as a once-in-a-life-time opportunity, and consider these price drops as advantageous discounts beyond the sober forecasts of analysts.[2]

Investing in what is the key question here. The tables have completely turned on some lockdown darlings, evident in Zoom’s mighty fall. Thus, a seemingly-favorable choice could be the well-grounded stocks which boasted exuberant growth over the past decade or so, or the catapulting stocks that impressed investors with flying colors, such as EV heavyweights Tesla, or the rising Nio which emerged out of the blue. As said by Warren Buffett, “It’s far better to buy a wonderful company at a fair price, than a fair company at a wonderful price”.

If you feel discouraged by these recession spooks, keep in mind that bear markets seldom happen, occurring just 10 times in the past 60 years, including the plummet of 22’. Additionally, recessions followed a consistent trend of declining drops & expediting recoveries. There is another perspective, however.

Investors have cause for concern, as the Feds keep printing more money, contradicting their attempts in taming inflation while the BRICS alliance gains more strength which jeopardizes the U.S. Dollar-denominated assets and the currency’s global reign.

Closing Thoughts

Karl Marx famously said: “History repeats itself, first as tragedy, second as farce."

The statement remains significant. If there’s one lesson to heed, it should be the imminent burst of the bubble. Initially experienced in the Dot Com phenomenon at the start of the new millennia, markets seem to have entered bubble mode in 2021, building momentum as the inevitable burst creeps closer. This is most evident in the recent fall of tech-centered Nasdaq.

To wrap up & answer the golden question, it remains highly subjective whether now’s the time to invest. A good investment strategy, thorough investment analysis & research, along with a heavy dose of patience and risk awareness would do you better than playing the waiting game.

* Past performance is no guarantee of future results.

[1,2] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or based on the current economic environment which is subject to change. Such statements are not guaranteeing of future performance. They involve risks and other uncertainties which are difficult to predict. Results could differ materially from those expressed or implied in any forward-looking statements.