This strategy consists of candle formations that will help us predict the future direction of the market. In our example, we will use the EUR / JPY currency pair, because the euro will tend to react impulsively to the changing market conditions against the Japanese yen, which can also benefit our strategy.

We chose a time frame of 240 minutes, ie four hours, to be able to capture larger movements on the chosen trading instrument.

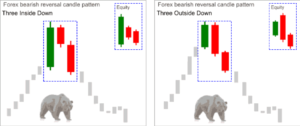

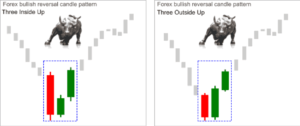

The basis for this strategy are two candle formations - one that predicts a change in trend from rising to falling, which should lead to a downward movement, and the other that predicts a change in trend from falling to rising, which means that after its display on the graph should move downwards.

The so-called bear turn (declining trend) is composed of three candles - the first is growth (usually a green candle with a wick up) and the second can be either rising or falling, but must be about the level of the previous growth candle, it means do not exceed significantly above or under this first candle. The third candle must end below the minimum of the second candle.

In bullish turnover, the situation is similar, but on the opposite side. The strategy begins with the first falling candle with the wick down (usually red), the second candle should be smaller than the first, and the last third candle must end above the maximum of the second candle.

We will enter long positions (ie shop) at the opening of the fourth candle. We would close the position after the end of this fourth candle, ie after four hours. As we can see in the chart, we would record three buying positions, with two ending in profit and the third in minimal loss.

Otherwise, we will sell (ie short-circuit) also at the opening of the fourth candle and we will close the position when this candle ends, ie after four hours. As we can see in the chart, we would realize two sales positions, one ending in a profit and one in a minimal loss.

However, it is necessary to realise that not even this strategy is not infallible and may not work in certain cases. It is possible to use it for other instruments.

This strategy is suitable also for advanced traders.

We can use a smaller stop loss for this strategy, e.g. 50 pips and we usually don't use the Take profit order.

However, it is important to realize that even this strategy is not infallible and in some cases may not work. It can also be used for other instruments.

This strategy is suitable for advanced traders.