The whole world is facing one of the highest inflations for the past few decades. However, it seems that Eurozone took the hardest hit, to which war in Ukraine could be on of many factors. Covid pandemic started an inevitable inflation growth, and the war was just additional oil on fire. At Ozios we decided to look at this problem, how it was and if it is getting any better. But first, let’s check the difference between headline inflation and core inflation.

Is euro area inflation on a downward trajectory? Or is high core inflation a threat in the future?

The whole world is facing one of the highest inflations for the past few decades. However, it seems that Eurozone took the hardest hit, to which war in Ukraine could be on of many factors. Covid pandemic started an inevitable inflation growth, and the war was just additional oil on fire. At Ozios we decided to look at this problem, how it was and if it is getting any better. But first, let’s check the difference between headline inflation and core inflation.

Inflation vs. core inflation [1] [2]

Inflation refers to a continuous increase in the general prices of goods and services over time, as measured by the annual percentage rise reported in the Consumer Price Index (CPI). As inflation grows, purchasing power diminishes, and it also affects the value of fixed assets, leads to adjustments in the pricing of goods and services by companies, financial markets respond, and there is an impact on investment portfolio composition. Inflation, to a certain extent, is an inevitable part of life that affects consumers, businesses, and investors alike, irrespective of how severe or when it occurs.

Core inflation refers to the change in the cost of goods and services, but it specifically excludes the costs of food and energy due to their high volatility. The consumer price index (CPI) is commonly used to calculate core inflation and it reflects the prices of goods and services.

Overall, both measures are important to monitor as they provide different information about the state of the economy. High levels of both inflation and core inflation can be dangerous and lead to economic problems, but policymakers may focus more on one or the other depending on their specific goals and concerns.

Inflation in Eurozone in the past year [3]

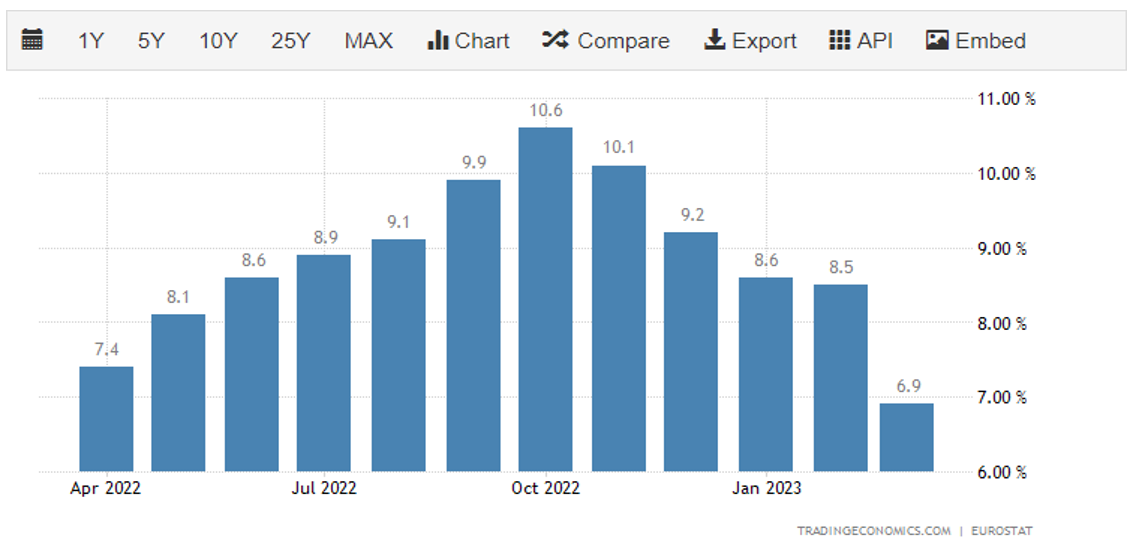

According to a preliminary estimate, the Euro Area's consumer price inflation rate slowed down to 6.9 percent YoY in March 2023, marking its lowest level since February 2022 and just below the market consensus of 7.1 percent. Despite the decrease, the reading still exceeded the European Central Bank's target of 2.0 percent, while the core index, which doesn't include volatile items such as food and energy, reached a new high of 5.7 percent, putting pressure on policymakers to raise rates further. The cost of energy declined for the first time in two years, while the prices of non-energy industrial goods rose at a slower pace. Meanwhile, inflation increased for both food, alcohol & tobacco, and services. Monthly, consumer prices rose by 0.9 percent in March, following a 0.8 percent increase in February.

Eurozone inflation rate for the last year. (Source: Trading Economics) *

Interest rate hikes [4]

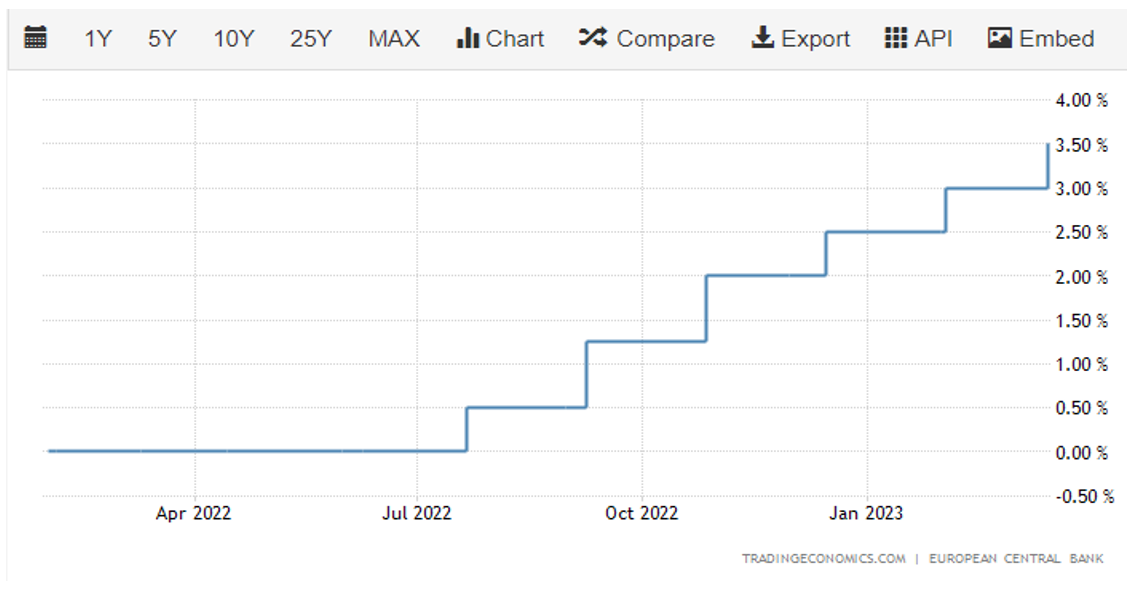

One, and probably the most efficient way to battle high inflation, is to rise interest rates. That way, the value of currency goes up, causing inflation to calm down. As mentioned earlier, despite that inflation is falling, core inflation is still at high levels, and especially much above the optimal target of ECB – 2%. For that reason, ECB decided to raise interest rates 6 times since July last year. Current interest rate for Eurozone is at 3,50 %, and many analysts and sources are warning that this might not be the top of it, as inflation still needs to be lowered. Plans for averaging inflation is: 5,3% in 2023; 2,9% in 2024 and 2,1% in 2025. To achieve that, ECB will have to make many actions to reach the goal, which seems far away for now.

Eurozone interest rates in the past year. (Source: Trading Economics) *

Conclusion

The Eurozone has been hit hard by one of the highest inflation rates in decades, which was exacerbated by the Covid pandemic and the war in Ukraine. Inflation and core inflation are both important measures to monitor as they provide different information about the state of the economy. Although the consumer price inflation rate in the Euro Area has slowed down to 6.9 percent YoY in March 2023, the core index reached a new high of 5.7 percent, which puts pressure on policymakers to raise interest rates further. The ECB has already raised interest rates six times since July last year, and the current interest rate for the Eurozone is 3.50 percent. However, analysts and sources warn that this might not be the top of it, and the ECB will have to take many actions to reach its inflation goals. In the end, it all depends how ECB will handle the inflation, and how quickly they will be able to lower it.

Adam Austera, Chief Analyst at Ozios

* Past performance is no guarantee of future results.

------------

[1] https://www.investopedia.com/terms/c/coreinflation.asp

Disclaimer:

The material herein is considered as marketing communication under the relevant laws and regulations, and as such is not a subject to any prohibition on dealing ahead of the dissemination of investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and should not be construed as containing investment advice, or an investment recommendation, or an offer of or solicitation for any transactions in financial instruments. The published content is intended for educational/informational purposes only. It does not take into account readers’ financial situation, personal experience or investment objectives. APME FX Trading Europe Ltd makes no representation that the information provided is accurate, current or complete; and therefore, assumes no liability for any losses arising from investments based on the supplied content. The past performance is not a guarantee of future results.

Tesla Seeks a New Growth Driver as First Robotaxi in Texas Aims to Convince Investors

The oil market has been shaken by Iran, Ukraine and fires in Canada

The price war in China’s car industry, led by BYD, threatens the entire market

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.95% of retail investor' accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Read our Risk Disclosures.