Warning on risks: Financial contracts for difference are complex instruments and are associated with a high risk of rapid financial losses due to leverage. On 76.44% of retail investor accounts, financial losses occur when trading financial contracts for difference with this provider. You should consider whether you understand how financial contracts for difference work, and whether you can afford to take the high risk of suffering financial losses. Please read the Risk Disclosures.

Development of major vaccine suppliers - Pfizer, BioNTech, Moderna

For the pharmaceutical companies that developed the Covid-19 vaccine, the approval of the fourth dose of the vaccine has been important over the past year. The US FDA approved it during March 2022, allowing companies to begin sales a few months ago. Let's take a look at whether the sale of the last dose had a direct impact on the development of the companies' shares and how the pharmaceutical leaders are doing today.

During the ongoing phase of the coronavirus spread, where we see an increasing trend mostly in the U.S., development during the fall period and the emergence of new variants and sub-variants of Covid-19 will be particularly critical. The FDA is recommending that manufacturers of the Covid-19 vaccine redesign booster vaccines to include components tailored to combat the currently dominant sub-variants of the coronavirus, Omicron's BA.4 and BA.5, starting this fall.

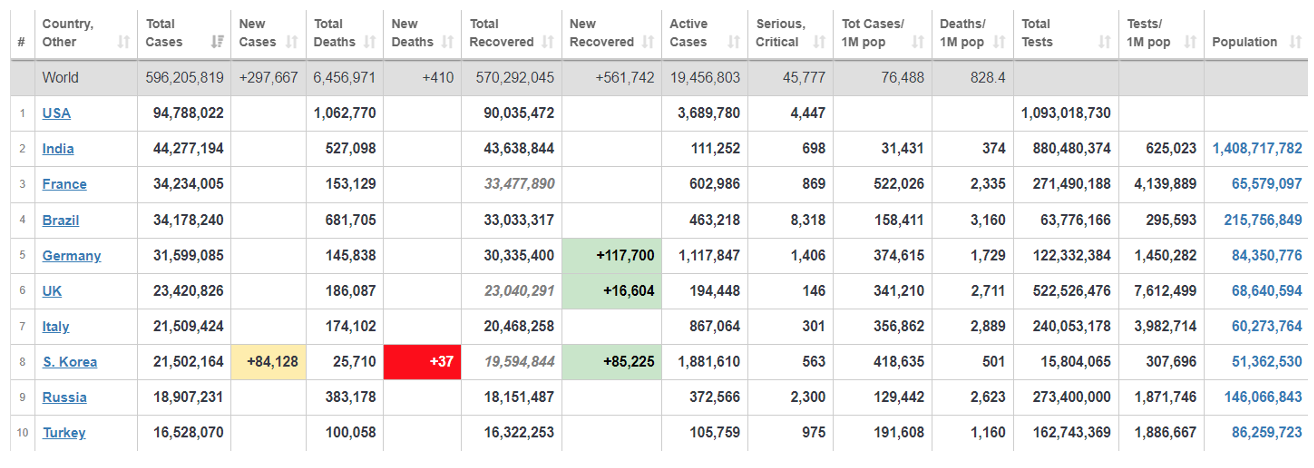

Incidence of coronavirus cases. (top 10 countries only, source: www.worldmeter.com)

Pfizer

Pharmaceutical company Pfizer's second-quarter revenue and profit beat Wall Street expectations. The biggest contributors were 2 products, sales of the Covid-19 vaccine and the antiviral treatment Paxlovide. For the second quarter, we saw a 47% increase over the same period last year and the largest quarterly sales in history. Pfizer posted a net profit of $9.9 billion. If we wanted to put it in percentage terms, the pharma giant improved 78% from the second quarter in 2021.

Well-known partners, Pfizer and Germany's BioNTech entered into a $3.2 billion deal this June that will provide the U.S. government with 105 million doses of vaccine. Pfizer boasts the distinction of being the first company to enter into a vaccine supply agreement with the US. The company is on solid financial footing and its focus is broadly diversified. The forecast for 2022 is to achieve revenues of approximately $97 billion, an increase of nearly 20% compared to 2021. [1]

Pfizer Inc's stock development over the last 5 years. (Source: Investing)

Pfizer is a well-established pharmaceutical company, with a profit margin of 27% and a return on equity of a respectable 47%. About a quarter of profits are returned to shareholders in the form of dividends. The current annual payout of $1.60 represents a 3.2% dividend yield, double the healthcare sector average.

BioNTech

Unfortunately, lower demand for vaccines has caused BioNTech to deal with a drop in sales of a vaccine known by the brand name Comirnaty. BioNTech's second-quarter sales were €3.2 billion, down 40% from the same period last year. Compared to the first quarter, sales were down by almost 50%. Wall Street had forecast second quarter sales of EUR 3.96 billion, which did not materialise, and after the announcement of the real results we could see that BioNTech's share price had fallen by 8% by the morning. Over the past year, the company's stock has seen a decline of approximately 50%.*

BioNTech SE's stock development over the last 5 years. (Source: Investing)

Corminata's sales revenue forecast for 2022 still remain at €13-17 billion. It is questionable whether this estimate will materialize and will depend on sales growth during the fall campaigns combined with the expected approval of the company's pair of omicron-adaptation vaccines. The approval and development of the adapted omicron BA.4/5 variant is likely to be a critical factor in achieving projected sales. The FDA's primary focus is on the BA.4/5 adapted vaccine.

Moderna

Moderna also stands by its full-year sales forecast of $21 billion for the COVID-19 vaccine. Despite the fact that the pharmaceutical company suffers from similar problems as other sellers, it has also been hit by the cancellation of supplies from low- and middle-income countries under the COVAX program. The cost of unused doses has ballooned to US$499 million. However, as a compensation, there is an emerging profit from new orders for booster doses. The excellent news is that Moderna has started production of a booster dose targeting the original coronavirus as well as the requested and recommended BA.4 and BA.5 sub-variants. Moderna achieved second quarter sales of $4.5 billion of COVID-19 vaccine. To assess the evolution of Moderna's stock, it has declined by approximately 50% over the past year.*

Moderna Inc's stock development over the last 5 years. (Source: Investing)

Adam Austera, analyst of Ozios

* Past performance is no guarantee of future results.

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which may change. Such statements are not guarantees of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.