Warning on risks: Financial contracts for difference are complex instruments and are associated with a high risk of rapid financial losses due to leverage. On 76.44% of retail investor accounts, financial losses occur when trading financial contracts for difference with this provider. You should consider whether you understand how financial contracts for difference work, and whether you can afford to take the high risk of suffering financial losses. Please read the Risk Disclosures.

Current impact of the pandemic on the world economy

It is impossible to talk about the global economic outlook to 2022 without addressing inflation. For decades, significant price increases have eluded most major markets. However, the World Economic Situation and Prospects (WESP) 2022 outlook warns that global economic recovery depends on balance amid new waves of COVID-19 disease, labour market challenges, persistent supply chain constraints and rising inflationary pressures. Overall economic optimism also continues to decline due to the geopolitical situation between Ukraine and Russia.

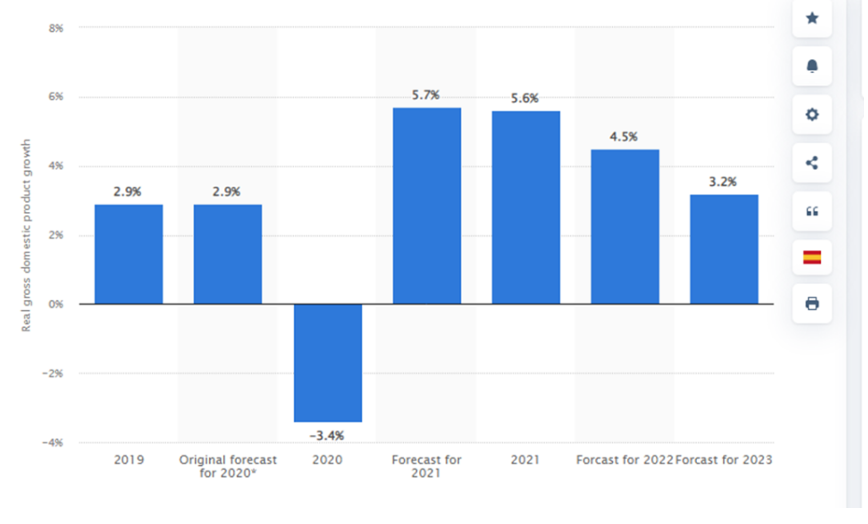

In 2020, global gross domestic product (GDP) fell by 3.4 percent, while the forecast for this year was 2.9 percent GDP growth. As the world's governments work toward a rapid economic recovery, GDP is projected to grow again by 5.6 percent in 2021. Morgan Stanley's forecast for 2022 is a 4.5 percent increase.1 The European Union's economy is expected to grow by four per cent over the same period.2

Expected growth in global real gross domestic product (GDP) due to coronavirus (COVID-19) from 2019 to 2023

(Source: https://www.statista.com/topics/6139/covid-19-impact-on-the-global-economy/#dossierKeyfigures)

Geopolitical conflict overshadows all other risks

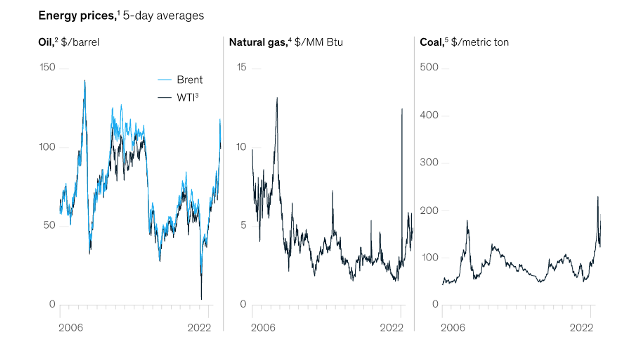

As the pandemic situation improves, economic uncertainty returns. Hence, three main challenges are constraining faster growth, namely the Russian invasion of Ukraine, which has triggered an energy crisis and a humanitarian shock, especially in Europe, high inflation and the COVID-19 pandemic.3 Each challenge triggers secondary economic effects with repercussions that are not always predictable. War and sanctions have created uncertainty about Russian energy commodities, and fear of supply disruptions are pushing energy prices higher. The price of crude oil (Brent) was close to USD 60 per barrel on 1 December, but has been rising steadily, touching USD 100 at the end of February after the conflict spilled over. Similarly, the price of natural gas and coal rose during this period. *

The development of the value of oil, where we can also see the sharp increase in the price recently.

Germany and Austria, whose economies are dependent on Russian natural gas, are experiencing record consumer inflation. Inflation indices for advanced economies show increases in consumer prices and products; the euro area experienced historically high producer price inflation of 31% in January. Producer price inflation is slowing. Meanwhile, food prices have also risen sharply and are expected to continue rising in the coming months.4 [1]

Will the dollar continue to dominate?

The war in Ukraine and the subsequent sanctions against the Russian Central Bank have led to questions about the future dominance of the US dollar. The US dollar and the euro are likely to remain dominant, not only as reserve currencies, but also as major trading currencies. [2] In fact, the dollar and the euro together account for about 80% of all international transactions. Economic performance in the first two months of 2022 reveals that demand has generally recovered to pre-pandemic levels, and that adjustments made to maintain output have mostly been sufficient to meet it.

Return to normal

The easing of restrictions following the taming of the third wave of the coronavirus has brought relief to economies around the world. Many companies could increase their employment and work on plans how to replace lost revenue. China, on the other hand, is experiencing a new wave of COVID-19, driven by the Omicron variant. While the number of active COVID-19 cases in China is negligible from a global perspective, the government there has responded quickly to suppress the spread of the virus.5

Despite the majority of the world's population having been vaccinated against COVID-19, the fourth wave of the coronavirus pandemic is already taking its toll in many countries around the world. Once again, global governments are under pressure to come up with new solutions to bring the situation under control while not putting people, jobs and businesses at enormous risk, which, if done right, could contribute to a strong, inclusive and sustainable recovery.

*Past performance is no guarantee of future results

[1,2] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which may change. Such statements are not guarantees of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.

2 https://www.statista.com/statistics/1102546/coronavirus-european-gdp-growth/