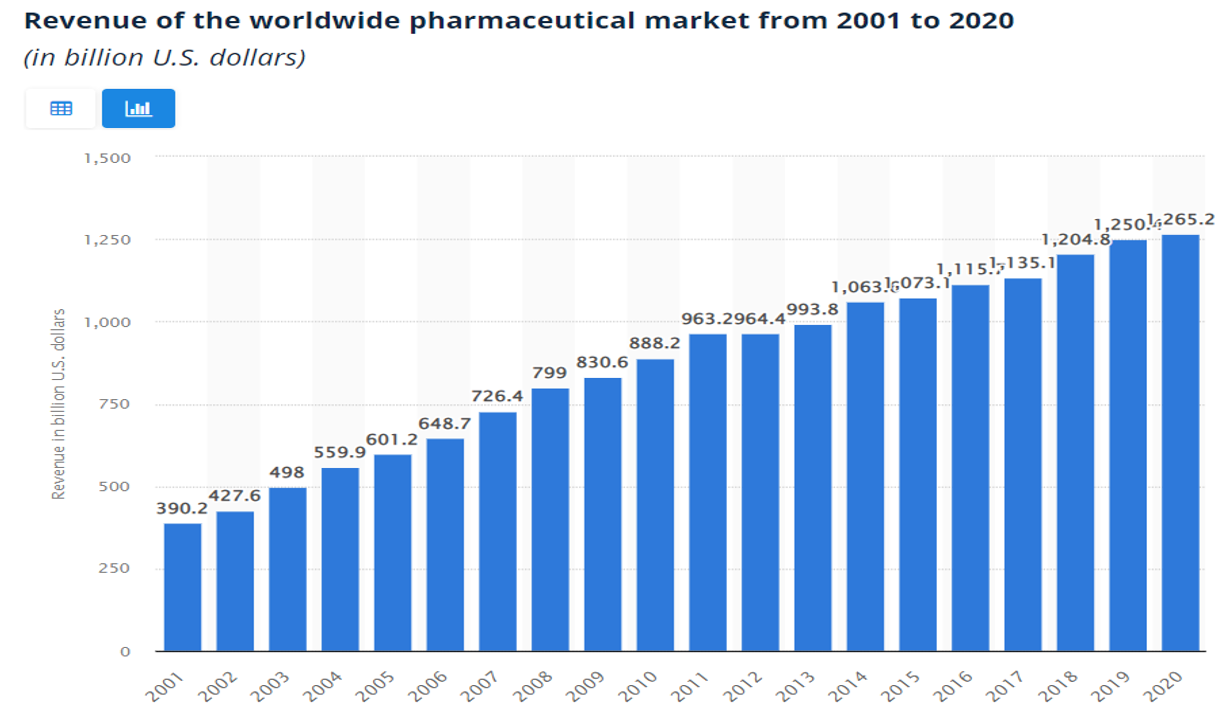

Pharmaceutical industry is one of the biggest industries in the world. It is also fast and constantly growing sector, as it increased from valuation of 390 billion U.S. dollars in 2001 to the total global market valuation at 1,27 trillion U.S. dollars in 2020. With its constant uptrend, it is projected that industry will be worth 1,70 trillion U.S. dollars by the end of 2025.

HOW PHARMACEUTICS ARE DOING THIS YEAR

Pharmaceutical industry is one of the biggest industries in the world. It is also fast and constantly growing sector, as it increased from valuation of 390 billion U.S. dollars in 2001 to the total global market valuation at 1,27 trillion U.S. dollars in 2020. With its constant uptrend, it is projected that industry will be worth 1,70 trillion U.S. dollars by the end of 2025. [1]

Globally, the United States has emerged as the leading market for pharmaceuticals, followed by emerging markets such as India, Russia, Brazil etc.

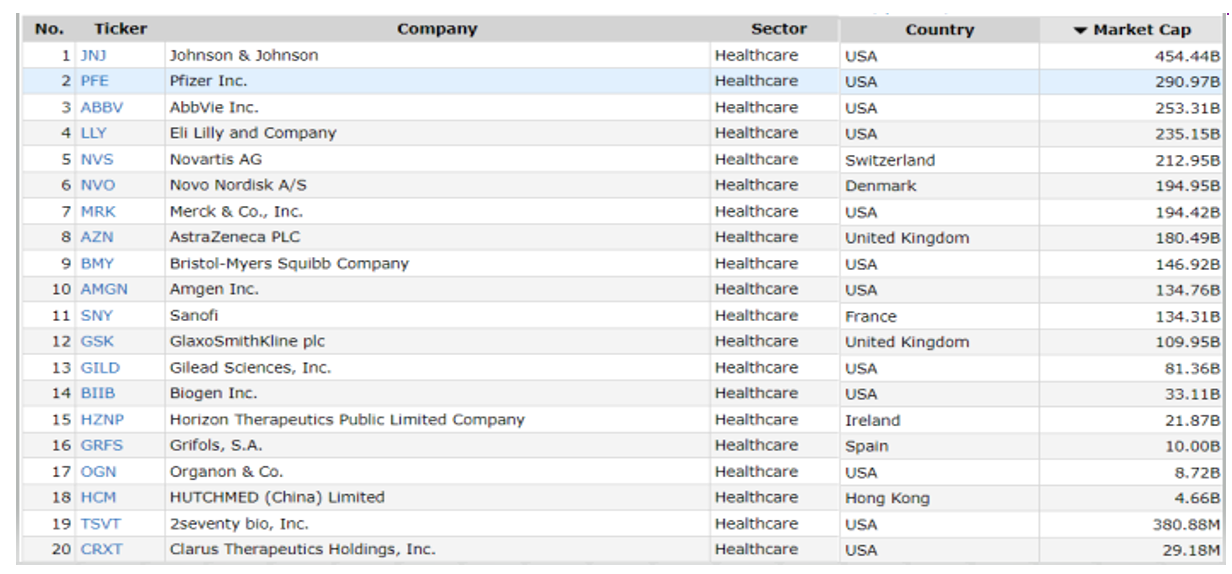

Not surprising, on the list of top 20 pharmaceutical companies by market capitalisation, leading 4 are based in United States. These are: Johnson & Johnson, Pfizer, AbbVie Inc. and Eli Lilly and Company. They are followed by Novartis from Switzerland on fifth place.

JOHNSON & JOHNSON

Johnson & Johnson is one of the leading vaccines producing companies. After the fall in March of 2020, at the start of pandemic, stock nicely grew from the point of 108 USD to todays 171,49 USD. In the beginning of the year, price was at 170 USD, but since correction on stock market fell to 158 USD. However, it quickly started to grow again. Target prices are set to 187 USD by Morgan Stanley and 195 USD by Goldman.[2]

PFIZER INC.

Not a very promising start of the year for this giant, however it seems price found support at price of 51 USD per stock. Since the beginning of the year, it fell for around 14 percent. Price is expected to be falling because of missed forecasted revenue. But company announced only revenue from deals already made and left out future deals – covid pill, vaccine against Omicron variant etc. Target prices are set to between 60 and 70 USD by UBS and BofA Securities. [3]

NOVARTIS

Also, Novartis entered this year with big volatility, but it is now on the same price as it was on 3rd of January, 87.21 USD. * They reported earnings release, which was positive, but not extra ordinary. On the other hand, Novartis is looking for approval from FDA for new Covid 19 treatments. All time high price was on 100 USD, so for now we are still around 10 percent below that point.

ASTRAZENECA

Same as previous company, AstraZeneca is also on the same price as it entered new year. * In financial reports firm said they have had 4 billion USD in sales, but they are expecting that revenue from Covid 19 related drugs will slow down in upcoming year. Sector that is not related to covid, made around 1,27 billion USD in sales. Not everything is so grey, for in the middle of January, it was approved that AstraZeneca’s jab is effective against Omicron.

SINOPHARM GROUP

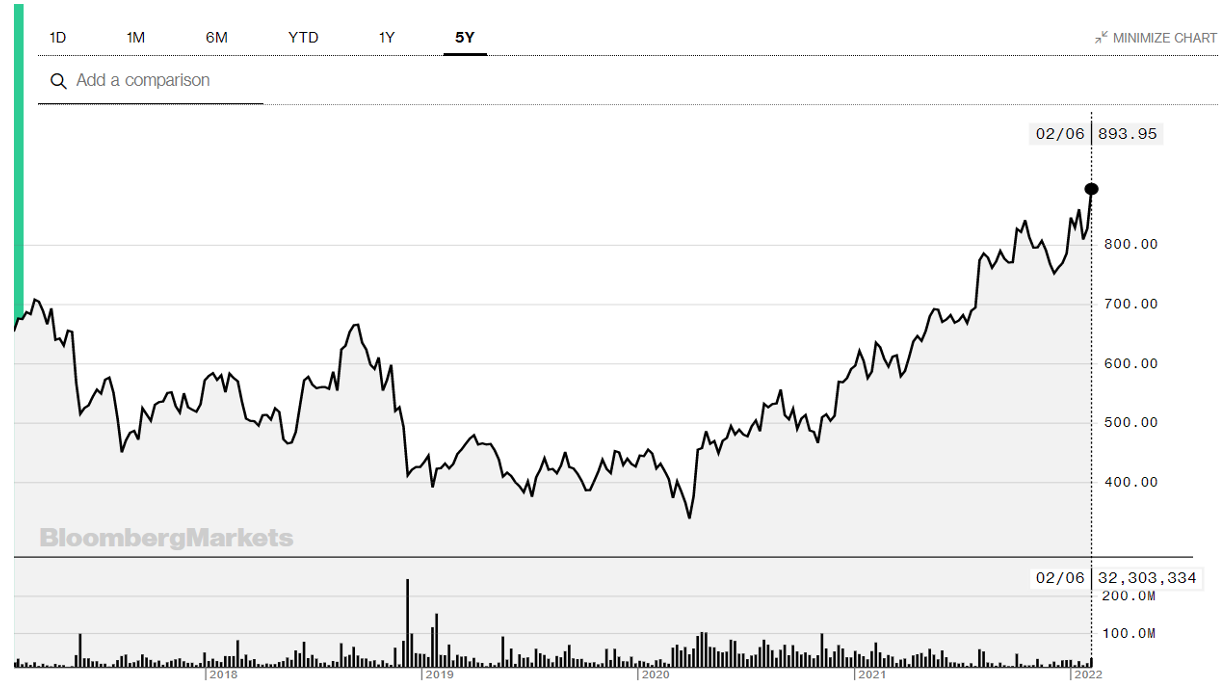

By far the biggest pharmaceutical company in China is Sinopharm Group. In sales value, it reached 270 billion USD, which is ten times more as the second on the list – Shanghai Pharmaceuticals, sales value of 27 billion dollars. Even though it is the largest Chinese pharmaceutical company, price of stock is constantly falling over the years, but this year it already made 9,77 percent growth.* From the chart point of view, we are now above support level, where the price stopped falling 4 times in past 5 years. Current price is 19,10 HKD.

SUN PHARMACEUTICAL INDUSTRIES

Sun Pharmaceutical Industries is the biggest company in this sector in India, country that is named “Pharmacy of the world”. Company first started as producer of psychiatric ailments. Now they offer also various drugs for therapeutic, gastroenterology and diabetology. They are supplying their medicines to over 150 countries across 6 continents. Year 2022 started promising for them, as the stock grew already for 5,05 percent – from 848 INR (cca. 11,20 USD) to 891,85 INR (cca. 11,89 USD).* From the chart we can see nice uptrend for the past few years.

SUMMARY

All in all, we can see uptrends on most of the pharmaceutical companies, same as it was for the past 20 years. If it will follow the trend, there is nice potential for industry expansion and continued growth of companies. Consequently, also rising prices on stock markets, if it will continue with this pace and predictions of reaching market value of 1,70 trillion USD will come true. [5]

* Past performance is no guarantee of future results

[1], [2], [3], [4], [5] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which may change. Such statements are not guarantees of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.

Sources:

https://www.statista.com/statistics/263102/pharmaceutical-market-worldwide-revenue-since-2001/

https://www.pharmaceutical-technology.com/features/top-ten-pharma-companies-in-2020/

https://www.beckershospitalreview.com/pharmacy/top-10-pharma-companies-by-revenue-in-2020.html

https://finviz.com/screener.ashx?v=111&f=ind_drugmanufacturersgeneral&o=-marketcap

https://finviz.com/quote.ashx?b=1&t=JNJ&ty=c&p=w&tas=0

https://finviz.com/quote.ashx?t=PFE&ty=c&p=d&b=1

https://finviz.com/quote.ashx?t=NVS&ty=c&p=d&b=1

https://finviz.com/quote.ashx?t=AZN&ty=c&p=d&b=1

https://finviz.com/quote.ashx?t=HCM&ty=c&p=d&b=1

https://finance.yahoo.com/news/novartis-q4-core-operating-income-061808128.html

https://finance.yahoo.com/news/astrazeneca-notches-3bn-covid-jab-082020626.html

https://www.statista.com/statistics/1180667/china-largest-pharmaceutical-companies-by-sales-value/

Odricanje od odgovornosti:

Materijal ovdje se smatra marketinškom komunikacijom prema relevantnim zakonima i propisima, i kao takav nije podložan bilo kakvoj zabrani trgovanja prije nego što se objavi investicijsko istraživanje. Nije pripremljen u skladu s pravnim zahtjevima osmišljenim za promicanje neovisnosti investicijskog istraživanja i ne smije se tumačiti kao sadržaj koji sadrži investicijske savjete, preporuke za ulaganje, ili ponudu ili poziv na bilo kakve transakcije u financijskim instrumentima. Objavljeni sadržaj namijenjen je isključivo obrazovnim/informativnim svrhama. Ne uzima u obzir financijsku situaciju, osobno iskustvo ili investicijske ciljeve čitatelja. APME FX Trading Europe Ltd ne daje jamstva da su informacije koje su pružene točne, aktualne ili potpune; i stoga ne preuzima nikakvu odgovornost za bilo kakve gubitke koji proizlaze iz ulaganja na temelju dostavljenog sadržaja. Prošla izvedba nije jamstvo budućih rezultata.

Nvidia and AMD shake up the US market with billion-dollar deals

Jedan od glavnih konkurenata Adobea izlazi na burzu

AstraZeneca se želi osigurati od carina ulaganjem koje Europa nikada prije nije vidjela

Upozorenje na rizik: CFD-ovi su složeni instrumenti i nose visoki rizik od brzog gubitka novca zbog poluge. 72.29% računa maloprodajnih investitora gubi novac prilikom trgovanja CFD-ovima s ovim pružateljem. Trebali biste razmotriti razumijete li kako CFD-ovi funkcioniraju i možete li si priuštiti preuzimanje visokog rizika od gubitka svog novca. Pročitajte naše Upozorenja o riziku.