The oil market fluctuated again at the beginning of June. Oil has begun to strengthen on a wave of geopolitical tensions and potential supply disruptions. Stalled negotiations with Iran, the escalation of the conflict between Russia and Ukraine and natural disasters in Canada are returning Brent oil prices above USD 65 per barrel.* Black gold thus confirms once again that it is not just an ordinary commodity, but a barometer of global instability.

The oil market has been shaken by Iran, Ukraine and fires in Canada

Geopolitical tensions continue

The most significant impact on the development of the oil price was the stalemate around the Iranian nuclear program. Negotiations between Tehran and Washington have reached an impasse, and everything indicates that Iran will reject the latest draft agreement. The reaction from the White House was swift and unambiguous – President Trump ruled out any concessions, including allowing uranium enrichment. In practice, this means that US sanctions remain in place and Iranian oil will not return to the world market anytime soon. At a time when every new supply is crucial, this blockage is one of the key factors that attracts price growth. Another geopolitical level comes into play – the conflict in Ukraine. Over the weekend, Ukraine carried out the largest operation on Russian territory since the beginning of the war. Its combat drones hit several targets, including military airfields.[1][2]

The West's reaction is in the form of a possible tightening of sanctions on Russian oil. This time, there is speculation about direct pressure on large importers – especially China and India. If such a move were to become a reality, the market would lose a significant part of the demand, forcing Russia to limit exports or redirect them at greater costs. As peace talks between Moscow and Kiev stalled and the Kremlin insists on territorial claims, oil remains under the influence of geopolitical tensions, which are unlikely to ease anytime soon.[3] [1]

Natural disasters in Canada

Natural risks are also added to the political risks. Wildfires are raging in Alberta, Canada, knocking out about seven percent of domestic oil production. In numbers, this is not a huge shortfall, but in the current situation, when the market is trying to balance between increased summer demand and limited supplies, it is additional pressure on the supply side. It is this combination of inaccessible Iranian oil, potential shortages from Russia and shortages in North America that makes oil a commodity that will not get cheaper in the coming weeks.[4]

OPEC+ increases production

However, there are no dramatic changes on the producers' side yet. Although OPEC+ agreed to increase production by 411 thousand barrels per day from July, this step was expected and the market accepted it calmly. The group thus continues to adhere to the strategy of controlled release of capacity, thus preventing a significant drop in prices. In the current context, this is seen as a positive – the increase is slow, but it provides some predictability.[5]

Price development and outlook

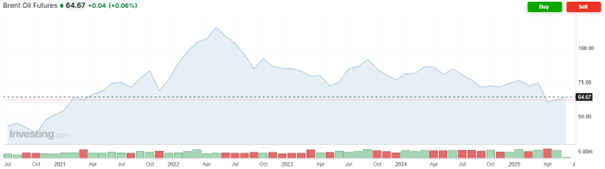

Brent crude oil prices returned above $65 a barrel on Monday, June 2, while WTI crude briefly crossed $62 a barrel.* The market is currently balancing all the aforementioned factors - expected OPEC+ production increases and rising margins in the refining sector with uncertainty over Iranian exports, tensions around Ukraine and tight supplies from Canada. The result is stability so far, but with a clear growth undertone.[6]

Oil is likely to hold above $60 in the coming weeks, especially if geopolitical tensions do not ease and Canadian production resumes quickly. Refining margins could be maintained during the summer season, but the market is likely to cool down after it ends. In the medium term, a possible tightening of Western sanctions on Russian exports – especially if they hit China and India – could shoot prices higher. On the other hand, if OPEC+ surprises with a faster increase in production or if the shortages from Canada resume, prices may return to a correction. [2]

Performance of the price of Brent and WTI crude oil over the last 5 years. (Source: investing.com)

Conclusion

In the long run, oil remains vulnerable to any shock – whether from politics, nature or the market. Although a gradual relaxation of environmental regulations and an increase in domestic mining can be expected in the US, this is a slow process. Therefore, if the market is showing anything today, it is the fact that the fragile balance on the supply side can be disturbed quickly, but only very slowly restored. And in such an environment, oil is once again turning into a commodity that the world cannot afford to underestimate.

* Past performance is not a guarantee of future results.

[1,2] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which is subject to change. Such statements are not a guarantee of future performance. They involve risks and other uncertainties that are difficult to predict. Results could differ materially from those expressed or implied in any forward-looking statements.

[1] https://hdfcsky.com/news/firstcry-stock-price-gains-today

[2] https://www.marketwatch.com/story/why-oils-rally-after-russias-pearl-harbor-moment-may-be-short-lived-851ff06b

[3] https://www.reuters.com/world/us/us-senate-may-work-russia-sanctions-bill-this-month-2025-06-02/?utm_source=chatgpt.com

[4] https://www.reuters.com/business/energy/oil-rises-iran-russia-canada-supply-concerns-2025-06-03/

[5] https://www.cnbc.com/2025/06/02/us-crude-oil-rises-after-opec-increases-output-at-steady-rate.html

[6] https://roboforex.com/beginners/analytics/forex-forecast/commodities/brent-oil-forecast-2025-06-03/

Disclaimer:

The material herein is considered as marketing communication under the relevant laws and regulations, and as such is not a subject to any prohibition on dealing ahead of the dissemination of investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and should not be construed as containing investment advice, or an investment recommendation, or an offer of or solicitation for any transactions in financial instruments. The published content is intended for educational/informational purposes only. It does not take into account readers’ financial situation, personal experience or investment objectives. APME FX Trading Europe Ltd makes no representation that the information provided is accurate, current or complete; and therefore, assumes no liability for any losses arising from investments based on the supplied content. The past performance is not a guarantee of future results.

Mercedes-Benz sold its stake in Nissan, shares of the Japanese carmaker fell sharply after the announcement

Nvidia and AMD shake up the US market with billion-dollar deals

One of Adobe’s Main Competitors Goes Public

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.29% of retail investor' accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Read our Risk Disclosures.