Kockázati figyelmeztetés: A pénzügyi különbözeti ügyletek (CFD-k) összetett eszközök, és a tőkeáttétel miatt magas kockázattal járnak, ami gyors pénzügyi veszteségekhez vezethet. Ennél a szolgáltatónál a lakossági befektetői számlák 76.44%-án pénzügyi veszteség keletkezik CFD-kereskedés során. Fontolja meg, hogy megérti-e, hogyan működnek a CFD-k, és hogy megengedheti-e magának a magas pénzügyi veszteség kockázatát. Kérjük, olvassa el a Kockázati Tájékoztatót.

Intel and Qualcomm: competitors in the service of US national security

The two companies were handed the contract as part of the Rapid Assure Microelectronics Prototypes - Commercial (RAMP-C) program, which aims to ensure that the U.S. Department of Defense (DoD) has reliable access to the latest 7nm and sub-7nm manufacturing technologies domestically.

The value and duration of the contract remains unclear, as does Qualcomm's specific role (as a semiconductor manufacturer that does not own its own fabs), but the agreement is expected to meet "the long-term microelectronics manufacturing needs of the U.S. Department of Defense."

About Intel

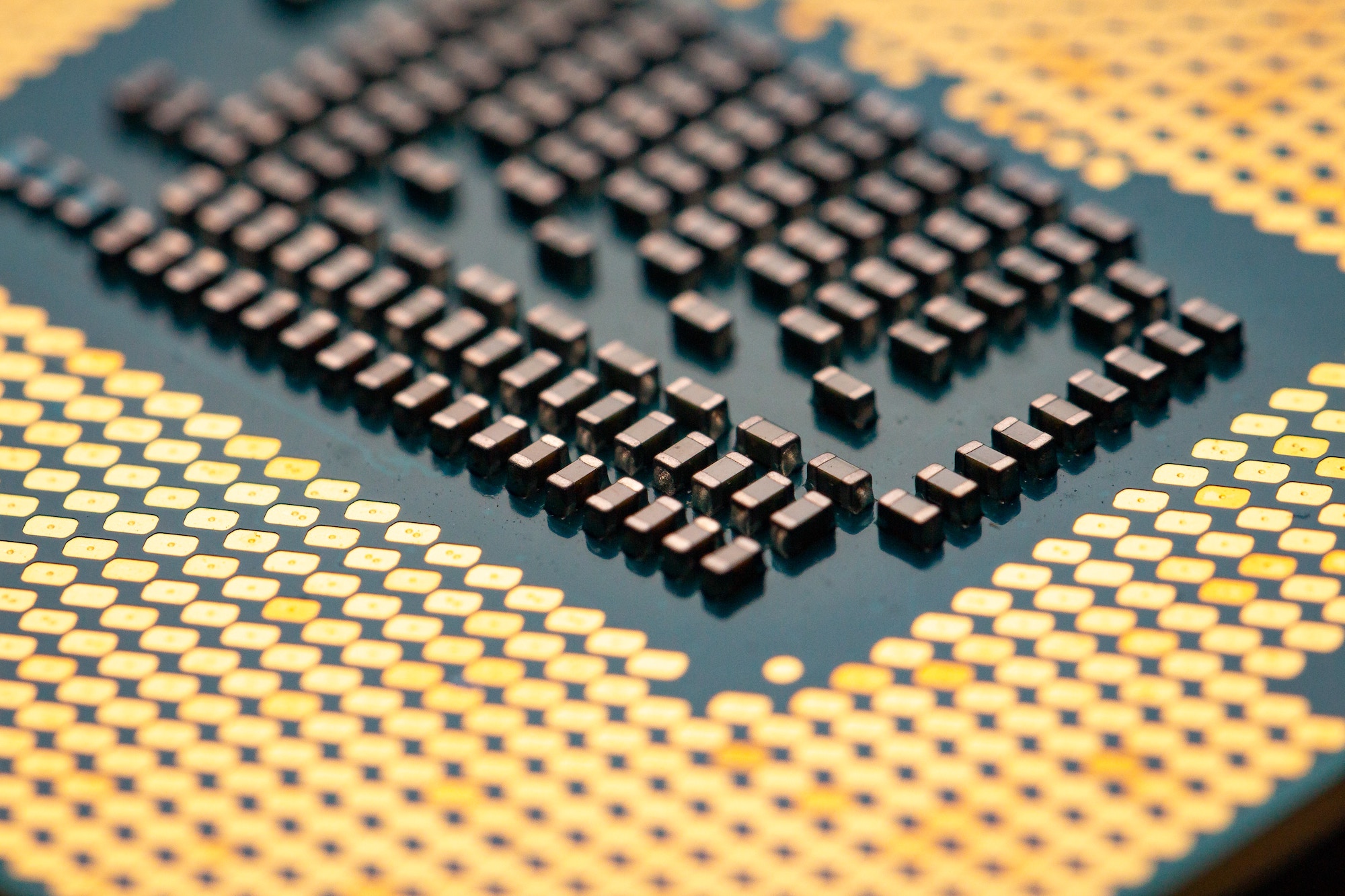

Intel Corp. is the world's largest manufacturer of central processing units and semiconductors. The company is best known for its processors based on the x86 architecture, which was created in the 1980s and has been continually modified, revised and upgraded. According to the company, "Our manufacturing processes are advancing in accordance with Moore's Law, delivering more and more functionality and performance, improved energy efficiency, and lower transistor costs with each new generation."

Intel prepares for strategic chip production for US defence

Intel is at the forefront of a possible multi-billion-dollar government funding drive to secure production of microchips to serve US defence and intelligence agencies, according to The Wall Street Journal, which cited people familiar with the matter.

The manufacturing facilities will be set up as "secure enclaves", according to the sources. The idea is to limit the US military's dependence on chips imported from East Asia, particularly Taiwan, because of perceived threats of Chinese territorial aggression.

With funding from the Biden administration's $53 billion chip bill, Intel may establish such an operation at its existing factory complex in Arizona.

The investment in these facilities could range between $3 billion and $4 billion. These funds are expected to be allocated from the $39 billion authorized for manufacturing grants under the Strategic Chip.[1]

Intel is concerned about the instability of manufacturing in Vietnam, taxes

Reuters reported in February that Intel is planning a new investment in Vietnam, worth an estimated $1 billion. The Vietnamese government's official website mentioned plans to attract an additional $3.3 billion in investment from Intel, but later removed the reference after media reports.

However, Intel eventually backed away from the planned investment, expressing concerns about the stability of power supply for its expanded plant and excessive bureaucracy. The company's decision comes after it announced major investments in Europe in June and Vietnam suffered from power shortages that same month, forcing many manufacturers to temporarily suspend production.

Intel and other multinationals operating in the country have also urged the Vietnamese government to offer them subsidy packages worth millions of dollars if it introduces new tax levy rules for large companies as part of a global overhaul of the tax system.

Intel's share price performance over the past 5 years (Source: Tradingview.com)*

Qualcomm is working with the U.S. Department of Defense

Qualcomm, which was also a signatory to a contract as part of the RAMP-C program by the U.S. Department of Defense (DoD), may be a producer of quality semiconductor technology, but it suffers from a certain disadvantage compared to Intel. As a sophisticated chip company, it does not own its own manufacturing facilities. As such, it can meet the 'long-term microelectronics manufacturing needs of the US Department of Defense', but its production facilities are located outside the US. Thus, they pose a greater security risk.

About Qualcomm

Qualcomm is a multinational company known for designing and manufacturing semiconductors and wireless telecommunications products. Qualcomm has three main business units - Qualcomm CDMA Technologies (QCT), Qualcomm Technology Licensing (QTL) and Qualcomm Strategic Initiatives (QSI).

Qualcomm announced its upcoming Snapdragon 8 Gen 4 chipset, which is set to revolutionize mobile technology in 2024. The new chip uses TSMC's low-power optimized N3E process, which boasts higher performance than the N3B process from Apple's A17 Pro. With the combination of a 3nm process and a separate architecture, Snapdragon 8 Gen 4 promises superior CPU and GPU performance.

Qualcomm CEO Cristiano Amon showed a chart during a recent presentation, stating that Qualcomm's Oryon outperformed Silicon Apple's M2 chip and Intel's i9-13980HX in single-core CPU performance, matching their peak performance but using 30% and 70% less power, respectively. Qualcomm continues to innovate in mobile technology. Qualcomm has a reputation for consistently delivering high returns on invested capital, and has maintained its dividend payout for 21 consecutive years.

Qualcomm's stock price performance over the past 5 years (Source: Tradingview.com)*

Conclusion:

Both US technology companies Intel and Qualcomm are leading chip makers. Their research and development capabilities enable them to supply technology for the defence of the United States. For this reason, both companies are also involved in strategic projects of the US Department of Defense.

-----

Adam Austera, Senior Analyst at Ozios

* Past performance is no guarantee of future results

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate or based on the current economic environment, which may change. Such statements are not guarantees of future results. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.

Sources:

https://www.techradar.com/news/intel-qualcomm-will-design-advanced-chips-for-us-military