Upozorenje na rizike: Financijski ugovori za razliku (CFD) složeni su instrumenti i povezani su s visokim rizikom brzih financijskih gubitaka zbog poluge. Na 76.44% računa malih ulagača dolazi do financijskih gubitaka pri trgovanju CFD-ovima s ovim pružateljem. Trebali biste razmotriti razumijete li kako CFD-ovi funkcioniraju i možete li si priuštiti visoki rizik financijskih gubitaka. Molimo pročitajte Obavijest o rizicima.

Economy comparison between EU and USA – who took the bigger hit?

The war between Russia and Ukraine put pressure on the whole world’s economy. Us, as consumers, can see the pressure in terms of inflation, or how our buying power is lower than it was before the war or before Covid pandemic. With other words, we can now buy less with the same amount of money that we were able to buy before. In the analysis you will find short comparison between the EU and USA economy before the war, and how it is now.

Pre-war comparison

Both, EU and US economies are known as two of the largest economies for years. As of 2021, both together share 42.4% and 30.7% of the global GDP. Europe produces more, however US economy is still larger, at least based on GDP data. The last time EU had bigger GDP than USA was in 2011, according to the IMF data. [1] Even though that USA was stronger or better, currency Euro remained more dominant than USD.

Currency comparison – EUR vs. USD

As mentioned, EUR was dominant for most of the time, however since the war in Ukraine, the value of it started to fall gradually. Of course, one reason why USD got stronger is also the interest hike in America, which Europe is postponing and did not take that measure yet. The first interest rate hike in Europe is expected to be in July. [2] That is also the reason why we can expect that EUR will go stronger against other currencies. In the beginning of February, the exchange rate was 1 EUR worth of around 1.14 USD, but since the geopolitical situation and all the sanctions, that were put on Russia, the current exchange rate is 1 EUR worth of around 1.07 USD. The last time currency pair was on this exchange rate was in March of 2020 when Covid started, but only for short period of time, and earlier in April of 2017. [3]

Movement of EUR vs. USD in the last five years. (Source: Trading Economics) *

Inflation rate

Both, Europe and USA are facing the worst inflation rates in the past decades. For the first time in the last 10 years, it is expected that Europe’s inflation will be bigger than U.S. The war caused one of the biggest rises in energy and commodities prices in history in Europe.[4] But not only war itself is to blame, but also the sanctions that Europe and USA put on Russia. In attempts to crash Russian economy and make rouble weaker, they have limited or even stopped the import of oil and gas from there. That means that supply got much lower, while demand stayed the same. The prices of diesel and gasolines already rose for more than 50% in some European countries, and it seems it will not calm down any time soon. The same goes for electricity bills.

Inflation in EU in May 2022 is expected to be 8.1% [5], which is for 0.7% higher than in April. In USA on the other hand, inflation in March was 8.5% and in April 8.3%. Given that EU’s inflation is growing, and US inflation is calming down, the predictions might be correct, that EU will have higher inflation rate than US. [6]

GDP comparison

First quarter reports in US showed, that GDP has lowered for around 1.5% in comparison with the previous quarter.[7]Europe, surprisingly, showed the growth of 5.6% in the first quarter of 2022 in comparison with the last year’s first quarter.[8]

The expectations for real GDP growth in 2022 in Europe are 2.7%, and 2.3% in 2023,[9] of course everything depends on how the war will go and when it will finish. GDP in USA is expected to have growth of 3.1% in 2022. [10]

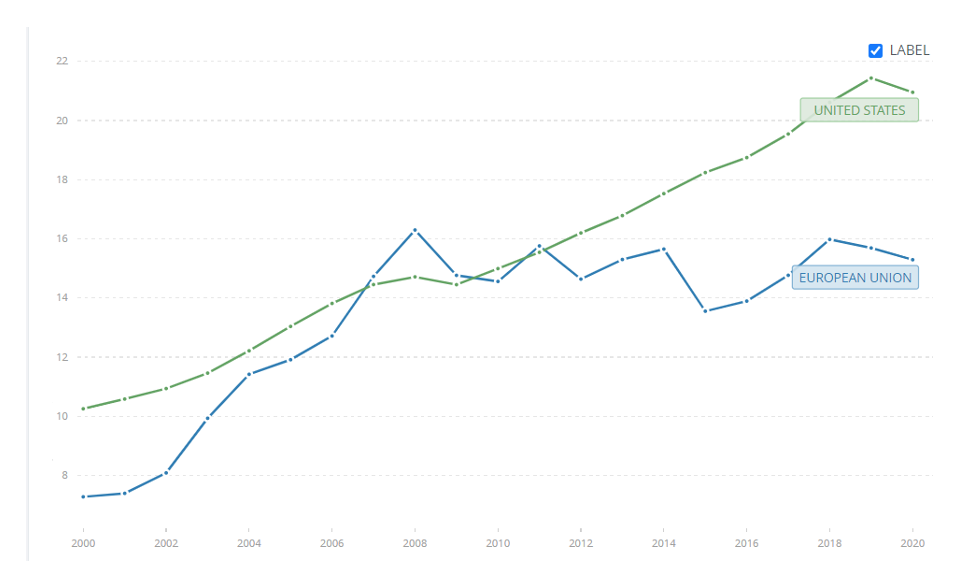

Comparison of US and EU GDP from 2000 to 2020. (Source: Data Worldbank)

Unemployment rate

Unemployment rate is another important indicator of countries economy health. Unemployment rates in both US and EU are nicely falling, which means that there can be seen nice improvement of economy and work force. However, US has far better percentage than EU. In The United States, the actual unemployment rate is at 3.6%, while in the European Union, unemployment rate is 6.8%, which means that almost one time more than US. [11] If the forecasts from analysts will come true, and we will face crisis and recession, then we can expect that this percentage will be even worse. Especially in Europe, as the war is happening here.

Conclusion

So far it seems that Europe has taken a bigger hit than the US, which was expectable, because Europe is highly dependent on the energy sources from Russia and Ukraine, which has stopped importing due to the war. It will take time that EU will find the replacement for the oil and gas, which means that there are times ahead of us, when inflation can get higher and with that damage the economy. The most important thing to remember here is that market always gives us opportunities and the worst thing you can do during inflation is to let your money sit on the bank account, as it loses its value day by day. Do not wait and start investing now!

* Past performance is no guarantee of future results.

-----------

[3]https://tradingeconomics.com/euro-area/currency

[6] https://tradingeconomics.com/country-list/inflation-rate

[7] https://www.bea.gov/news/2022/gross-domestic-product-first-quarter-2022-advance-estimate

[11] https://www.oecd.org/newsroom/unemployment-rates-oecd-update-may-2022.htm