It will soon be two years since the outbreak of the COVID-19 virus. Despite the development of new vaccines and the efforts of a global approach to vaccination, many are still wondering what the recovery of the global economy might look like and whether it can recover from a pandemic. However, its outlook does not look ideal yet. The International Monetary Fund (IMF) lowered its July forecast of global economic growth to 5.9 percent in 2021 in its October World Economic Outlook report, and the outlook for 2022 remains at the same level, namely 4.9 percent.

Will the global economy recover from the effects of the pandemic?

It will soon be two years since the outbreak of the COVID-19 virus. Despite the development of new vaccines and the efforts of a global approach to vaccination, many are still wondering what the recovery of the global economy might look like and whether it can recover from a pandemic. However, its outlook does not look ideal yet. The International Monetary Fund (IMF) lowered its July forecast of global economic growth to 5.9 percent in 2021 in its October World Economic Outlook report, and the outlook for 2022 remains at the same level, namely 4.9 percent.

Power outages and rising prices

The coronavirus pandemic has affected almost every country in the world, and its spread has deepened the indebtedness of national economies and businesses. As governments continue to struggle with new restrictions and measures to stop the spread of the virus, economically stable countries have applied a large amount of fiscal stimulus to shift public debt to pre-pandemic levels, but dangerous disparities in economic prospects between countries remain a problem.

Although the forecast decreased by only 0.1 percentage point compared to the previous quarter, in practice the impact of the pandemic on some countries is much more pronounced. Advanced economies are struggling with supply disruptions due to renewed demand, and the world is facing an energy crisis. China is struggling with power outages, Europe is trying to take every step to ensure that such a scenario does not happen, but businesses and end consumers are noticing the rise in prices. The United Kingdom, on the other hand, is struggling with fuel shortages and rising gas prices by hundreds of percent.

Insufficient vaccination in developing countries

The huge differences in vaccination are also a problem, as a result of which, for example, developing countries have limited access to vaccination. According to the IMF, while almost 60 percent of the world's advanced economies are fully vaccinated and some receive a booster vaccine, about 96 percent of the population in low-income countries remains unvaccinated. Although there is no final report on the economic damage caused by the global COVID-19 pandemic, economists agree that this will have a negative impact on the world economy.[1]There are still a number of health risks that hinder the return to "normal".

The world is at a global turning point where leaders must co-operate, innovate and recover the economy, as well as other sectors,"[2]said Sarita Nayyar, CEO of the World Economic Forum, adding that corporations, civil society and governments must work together to solve the major challenges that the countries are facing.

Automation and digitization

The pandemic has accelerated trends in automation and digitization. This has led to job losses in some sectors. Instead, new jobs are likely to be created that are less demanding on human resources. In particular, it will involve the transformation of jobs that involve routine tasks with the possibility of standardizing them at low to medium levels of skills in manufacturing, hospitality, catering and retail, which are at risk of being replaced by robots and artificial intelligence (AI).

The pandemic highlighted the need for increased public spending in a number of sectors, such as healthcare. Restrictions and social distance have exhausted corporate cash flows and

Government assistance to companies in difficulty came mainly in the form of cheap loans. Debt overhang in the current environment of low interest rates is a challenge for policy makers.

On the one hand, the corporate sector must go through a process of debt reduction to restore healthy development, on the other hand, companies that need restructuring most have the least chance of adapting to the new environment.[3]

A slump in GDP

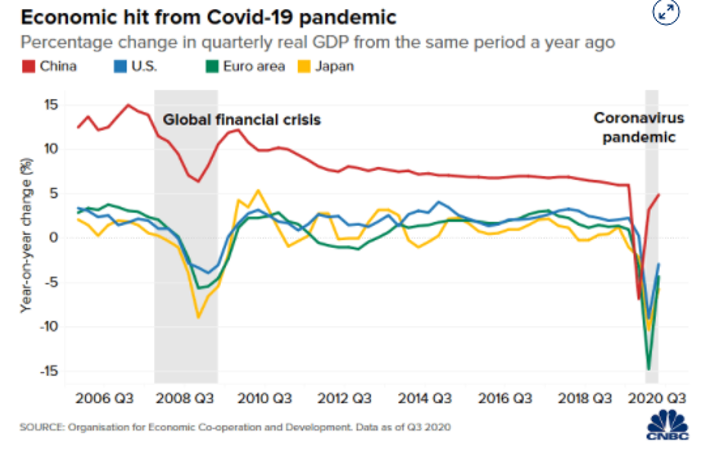

The effects can also be felt on the development of GDP, which fell to a record low in a number of countries. In 2020, global GDP reached about 84.54 trillion US dollars, which, according to Statista.com, is almost three trillion less than in 2019.

[4]Graph of the year-on-year percentage share of quarterly real GDP in the USA, Europe, Japan and China

Central banks in advanced economies - including the Fed and the European Central Bank (ECB) - have increased their asset purchases to concentrate more money in the financial system. Inflationary pressures are one of the main risk factors that should ease in most countries in 2022. However, some developing countries must expect to remain under their pressure. Their situation and subsequent recovery will also be exacerbated by high global debt, which amounts to about 100 percent of GDP.

In addition, IMF chief Kristalina Georgieva warned that further increases in inflation expectations could result in a significant rise in interest rates and tightening financial conditions.

According to some experts, preparation for the post-pandemic economy should include a solution to the financial problems left by the pandemic, such as barriers to raising human capital, facilitating new growth opportunities related to green technologies and digitalisation, reducing inequalities and ensuring sustainable public finances.

[1]https://www.imf.org/en/Publications/WEO/Issues/2021/10/12/world-economic-outlook-october-2021?fbclid=IwAR3ZiEwx3bhA0eXfVD0YQcqA2xoxeWUMPN8Os5NQYfL0iKtrdFlSN_7lw

[2]https://www.financialexpress.com/economy/majority-of-global-public-thinks-economic-recovery-to-take-time-indians-3rd-most-optimistic-wef-study/2305342/

[3]https://www.eiu.com/n/campaigns/how-the-pandemic-changed-the-global-economy-download-success

[4]https://www.cnbc.com/2020/12/28/5-charts-show-covid-impact-on-the-global-economy-in-2020.html

Descargo de responsabilidad:

El presente material se considera una comunicación de marketing con arreglo a las leyes y reglamentos pertinentes y, como tal, no está sujeto a ninguna prohibición de negociación anterior a la publicación de estudios de inversiones. No se ha elaborado de conformidad con los requisitos legales destinados a promover la independencia de los estudios de inversiones y no debe interpretarse que contiene asesoramiento en materia de inversiones, ni una recomendación de inversión, ni una oferta o solicitud de operaciones con instrumentos financieros. El contenido publicado tiene solo fines educativos/informativos. No tiene en cuenta la situación financiera, la experiencia personal o los objetivos de inversión de los lectores. APME FX Trading Europe Ltd no garantiza que la información proporcionada sea exacta, actual o completa y por lo tanto, no asume ninguna responsabilidad por cualquier pérdida derivada de las inversiones basadas en el contenido proporcionado. El rendimiento pasado no es garantía de resultados futuros.

Tesla busca un nuevo motor de crecimiento mientras el primer robotaxi de Texas intenta convencer a los inversores

El mercado del petróleo se ha visto sacudido por Irán, Ucrania y los incendios en Canadá

La guerra de precios en la industria automovilística china, liderada por BYD, amenaza a todo el mercado

Advertencia de riesgo: Los CFD son instrumentos complejos y conllevan un alto riesgo de perder dinero rápidamente debido al apalancamiento. El 78.95% % de las cuentas de inversores minoristas pierden dinero al negociar CFD con este proveedor. Debe considerar si comprende cómo funcionan los CFD y si puede permitirse asumir el alto riesgo de perder su dinero. Por favor lea nuestras divulgaciones de riesgos.