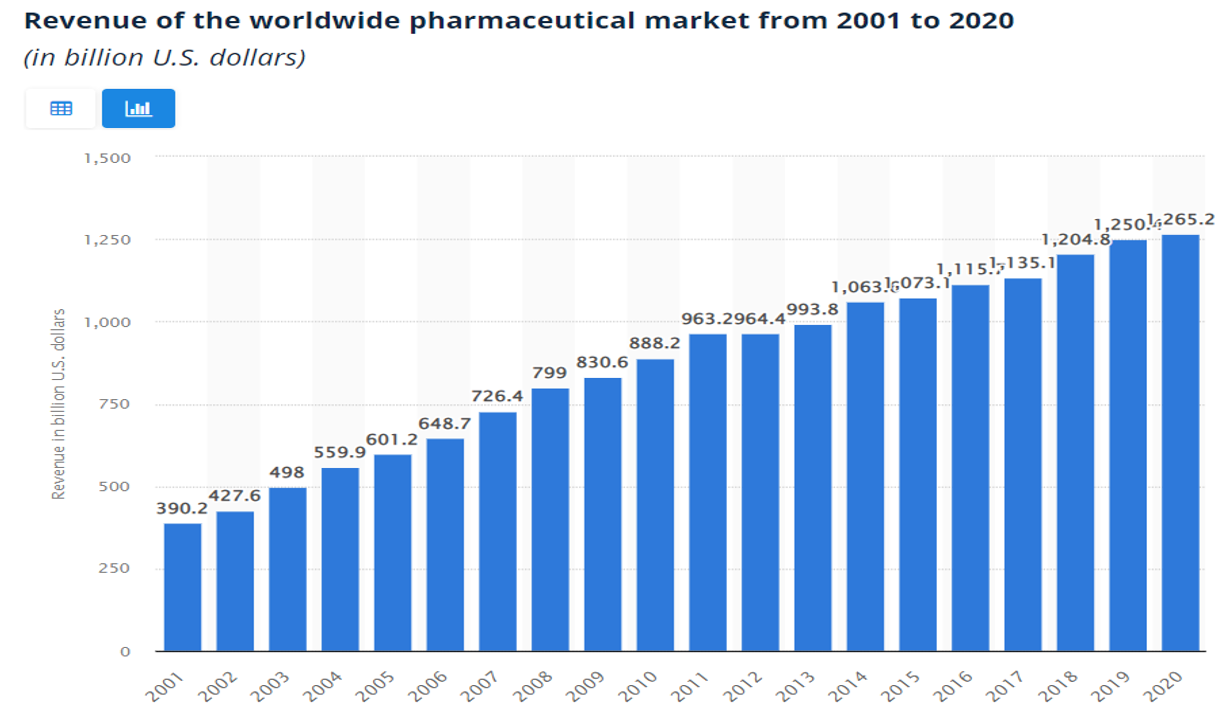

Pharmaceutical industry is one of the biggest industries in the world. It is also fast and constantly growing sector, as it increased from valuation of 390 billion U.S. dollars in 2001 to the total global market valuation at 1,27 trillion U.S. dollars in 2020. With its constant uptrend, it is projected that industry will be worth 1,70 trillion U.S. dollars by the end of 2025.

HOW PHARMACEUTICS ARE DOING THIS YEAR

Pharmaceutical industry is one of the biggest industries in the world. It is also fast and constantly growing sector, as it increased from valuation of 390 billion U.S. dollars in 2001 to the total global market valuation at 1,27 trillion U.S. dollars in 2020. With its constant uptrend, it is projected that industry will be worth 1,70 trillion U.S. dollars by the end of 2025. [1]

Globally, the United States has emerged as the leading market for pharmaceuticals, followed by emerging markets such as India, Russia, Brazil etc.

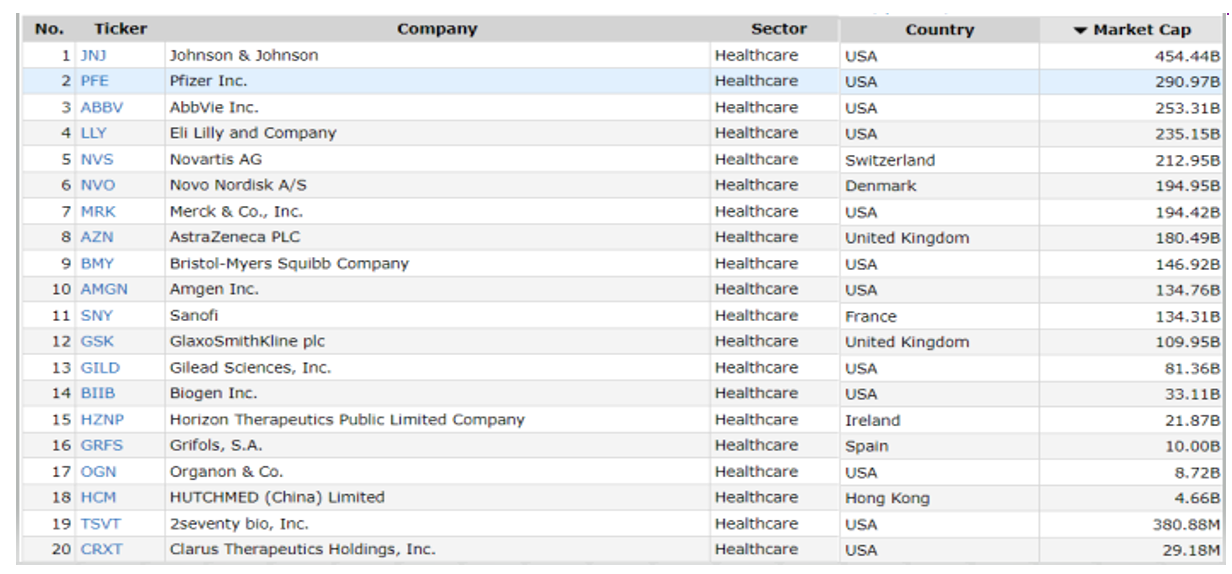

Not surprising, on the list of top 20 pharmaceutical companies by market capitalisation, leading 4 are based in United States. These are: Johnson & Johnson, Pfizer, AbbVie Inc. and Eli Lilly and Company. They are followed by Novartis from Switzerland on fifth place.

JOHNSON & JOHNSON

Johnson & Johnson is one of the leading vaccines producing companies. After the fall in March of 2020, at the start of pandemic, stock nicely grew from the point of 108 USD to todays 171,49 USD. In the beginning of the year, price was at 170 USD, but since correction on stock market fell to 158 USD. However, it quickly started to grow again. Target prices are set to 187 USD by Morgan Stanley and 195 USD by Goldman.[2]

PFIZER INC.

Not a very promising start of the year for this giant, however it seems price found support at price of 51 USD per stock. Since the beginning of the year, it fell for around 14 percent. Price is expected to be falling because of missed forecasted revenue. But company announced only revenue from deals already made and left out future deals – covid pill, vaccine against Omicron variant etc. Target prices are set to between 60 and 70 USD by UBS and BofA Securities. [3]

NOVARTIS

Also, Novartis entered this year with big volatility, but it is now on the same price as it was on 3rd of January, 87.21 USD. * They reported earnings release, which was positive, but not extra ordinary. On the other hand, Novartis is looking for approval from FDA for new Covid 19 treatments. All time high price was on 100 USD, so for now we are still around 10 percent below that point.

ASTRAZENECA

Same as previous company, AstraZeneca is also on the same price as it entered new year. * In financial reports firm said they have had 4 billion USD in sales, but they are expecting that revenue from Covid 19 related drugs will slow down in upcoming year. Sector that is not related to covid, made around 1,27 billion USD in sales. Not everything is so grey, for in the middle of January, it was approved that AstraZeneca’s jab is effective against Omicron.

SINOPHARM GROUP

By far the biggest pharmaceutical company in China is Sinopharm Group. In sales value, it reached 270 billion USD, which is ten times more as the second on the list – Shanghai Pharmaceuticals, sales value of 27 billion dollars. Even though it is the largest Chinese pharmaceutical company, price of stock is constantly falling over the years, but this year it already made 9,77 percent growth.* From the chart point of view, we are now above support level, where the price stopped falling 4 times in past 5 years. Current price is 19,10 HKD.

SUN PHARMACEUTICAL INDUSTRIES

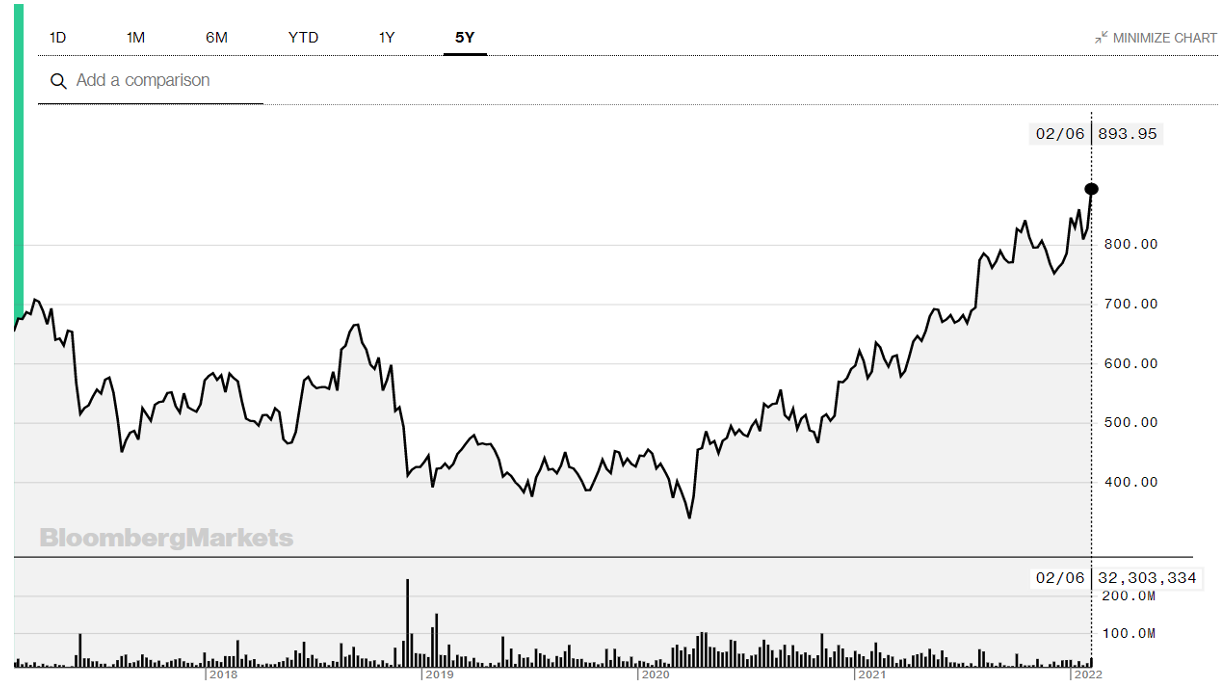

Sun Pharmaceutical Industries is the biggest company in this sector in India, country that is named “Pharmacy of the world”. Company first started as producer of psychiatric ailments. Now they offer also various drugs for therapeutic, gastroenterology and diabetology. They are supplying their medicines to over 150 countries across 6 continents. Year 2022 started promising for them, as the stock grew already for 5,05 percent – from 848 INR (cca. 11,20 USD) to 891,85 INR (cca. 11,89 USD).* From the chart we can see nice uptrend for the past few years.

SUMMARY

All in all, we can see uptrends on most of the pharmaceutical companies, same as it was for the past 20 years. If it will follow the trend, there is nice potential for industry expansion and continued growth of companies. Consequently, also rising prices on stock markets, if it will continue with this pace and predictions of reaching market value of 1,70 trillion USD will come true. [5]

* Past performance is no guarantee of future results

[1], [2], [3], [4], [5] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which may change. Such statements are not guarantees of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.

Sources:

https://www.statista.com/statistics/263102/pharmaceutical-market-worldwide-revenue-since-2001/

https://www.pharmaceutical-technology.com/features/top-ten-pharma-companies-in-2020/

https://www.beckershospitalreview.com/pharmacy/top-10-pharma-companies-by-revenue-in-2020.html

https://finviz.com/screener.ashx?v=111&f=ind_drugmanufacturersgeneral&o=-marketcap

https://finviz.com/quote.ashx?b=1&t=JNJ&ty=c&p=w&tas=0

https://finviz.com/quote.ashx?t=PFE&ty=c&p=d&b=1

https://finviz.com/quote.ashx?t=NVS&ty=c&p=d&b=1

https://finviz.com/quote.ashx?t=AZN&ty=c&p=d&b=1

https://finviz.com/quote.ashx?t=HCM&ty=c&p=d&b=1

https://finance.yahoo.com/news/novartis-q4-core-operating-income-061808128.html

https://finance.yahoo.com/news/astrazeneca-notches-3bn-covid-jab-082020626.html

https://www.statista.com/statistics/1180667/china-largest-pharmaceutical-companies-by-sales-value/

Descargo de responsabilidad:

El presente material se considera una comunicación de marketing con arreglo a las leyes y reglamentos pertinentes y, como tal, no está sujeto a ninguna prohibición de negociación anterior a la publicación de estudios de inversiones. No se ha elaborado de conformidad con los requisitos legales destinados a promover la independencia de los estudios de inversiones y no debe interpretarse que contiene asesoramiento en materia de inversiones, ni una recomendación de inversión, ni una oferta o solicitud de operaciones con instrumentos financieros. El contenido publicado tiene solo fines educativos/informativos. No tiene en cuenta la situación financiera, la experiencia personal o los objetivos de inversión de los lectores. APME FX Trading Europe Ltd no garantiza que la información proporcionada sea exacta, actual o completa y por lo tanto, no asume ninguna responsabilidad por cualquier pérdida derivada de las inversiones basadas en el contenido proporcionado. El rendimiento pasado no es garantía de resultados futuros.

Una alternativa a los metales preciosos: El cobre es más caro gracias al desarrollo tecnológico

Inversión grande en una empresa árabe de inteligencia artificial: Microsoft se expande por Oriente Medio

Llegan las vacunas de nueva generación de Moderna

Advertencia de riesgo: Los CFD son instrumentos complejos y conllevan un alto riesgo de perder dinero rápidamente debido al apalancamiento. El 86,61% % de las cuentas de inversores minoristas pierden dinero al negociar CFD con este proveedor. Debe considerar si comprende cómo funcionan los CFD y si puede permitirse asumir el alto riesgo de perder su dinero. Por favor lea nuestras divulgaciones de riesgos.