Warning on risks: Financial contracts for difference are complex instruments and are associated with a high risk of rapid financial losses due to leverage. On 76.44% of retail investor accounts, financial losses occur when trading financial contracts for difference with this provider. You should consider whether you understand how financial contracts for difference work, and whether you can afford to take the high risk of suffering financial losses. Please read the Risk Disclosures.

How 5 Luxury Icons Performed in 2025: Their Black Friday approach is Different Than What You Might Expect

Black Friday in this case is not just about discounts

The global luxury market has softened slightly, but individual categories show different paces. That is why the ability to use Black Friday correctly is important not only from the point of view of retailers, but also investors who want to understand which brands can protect margins and which are forced to retreat from their positions. A significant role is also played by the strong growth of mobile shopping. Thanks to it, retailers can personalize offers and target specific consumer segments. This means that the premium segment is modernizing at a speed few would have expected just a few years ago. The result is a sharply divided market where wealthier customers shop without needing substantial discounts, while a broader group looks for a premium product at a reasonable price. Black Friday is therefore becoming a test of a brand’s ability to address both groups at the same time.

LVMH: A glimpse of turnaround thanks to Asia

LVMH hardly ever discounts its flagship brands like Louis Vuitton and Dior during Black Friday, relying instead on limited online bundles or travel and seasonal exclusives in order not to formally undermine the image of full price. Deeper discounts are shifted into less premium brands and into the cosmetics and selective retail segment, where discounts pose less of a threat to its prestige. The conglomerate entered this year under pressure from a slowdown in demand in Asia, especially China, which has long been one of its main growth engines.

The latest figures, however, bring the first hint of a turnaround. In the third quarter, revenues reached approximately €18.3 billion, marking a return to organic year-on-year growth of 1% and the first positive quarter this year. For the first nine months of 2025, the group generated around €58.1 billion in revenue. Compared with last year, this still represents roughly a 4% decline in sales. Nevertheless, visible improvement can be seen in Asia, while the United States and Europe are showing stable figures, supported mainly by a partial recovery in local demand. The key fashion and leather goods division, which includes the best-known names such as Louis Vuitton and Dior, is still down year-on-year, but in the third quarter the decline moderated to around 2% after a much weaker first half.

LVMH shares traded on Euronext Paris were moving around €620 per share at the end of November after strong volatility during the year, reflecting more of a transition phase between the previous decline and the expected gradual recovery.*[1][2]

LVMH share price performance over the last 5 years. (Source: tradingview.com)

Hermès: An untouchable stronghold in the luxury sector

This giant avoids any price adjustments outside of its long-established policy during Black Friday. For Hermès, this shopping frenzy works more as a reinforcement of the myth of unattainability than as a sales event. Nevertheless, it continues to show stable growth, and its iconic products are becoming a safe harbour for customers who are looking not only for quality but also for value over time. Rising sales and high margins show that tradition, an emphasis on craftsmanship and limited supply create an effective model that holds its position even in challenging periods.

In the third quarter, the company recorded revenues of approximately €3.9 billion, and cumulatively for the first nine months of the year they climbed to €11.9 billion, representing about 9% year-on-year growth at constant exchange rates. The value of its handbags on the secondary market continues to rise, adding another layer of uniqueness.

From an investment perspective, this is a brand worth following in the long term, but the entry price is high and much of its growth potential is already reflected in the valuation. Hermès shares, listed on Euronext Paris under the ticker RMS, slipped into a correction after a February high above €2,900 and are trading around €2,100 per share at the end of November, significantly below this year’s peak but still well above the sector’s long-term average.*[3],[4],[5]

Hermès share price performance over the last 5 years. (Source: tradingview.com)

Richemont: A company built on jewellery

Like its competitors, the Richemont group tries to avoid blanket discounts during Black Friday. It offers added value to its customers through experiential events and exclusive presentations. This approach is key to reaching its core clientele, which is not looking for price advantages but for brand prestige.

Richemont is delivering the strongest recovery this year among the major luxury conglomerates. For the six months to September 30, it reported revenues of €10.6 billion, up 5% at current exchange rates (10% at constant currencies), while Cartier, Van Cleef & Arpels and other jewellery houses increased sales by 9% to around €7.75 billion and grew by as much as 14% at constant currencies. Demand from the wealthiest tier of clients therefore remains exceptionally strong, even though specialist watchmakers are reporting roughly a 6% decline in sales, which does not pose a fundamental threat, as the jewellery division now generates the bulk of group profits.

Richemont shares, primarily traded on the SIX Swiss Exchange, rank among the best-performing luxury stocks in 2025, with their price up by roughly one-third since the start of the year.*[6]

Richemont share price performance over the last 5 years. (Source: tradingview.com)

Kering: The greatest uncertainty of the year

Kering is still struggling mainly with the performance of Gucci, which is dragging its results down. Black Friday therefore presents a complicated situation. Deep discounts would damage the brand’s positioning, yet rising inventories suggest that some form of support is needed. The group is trying to strengthen its own retail network and reduce wholesale, but this process takes time.

In the first half of the year, Kering’s revenues were €7.6 billion, which was 16% less than a year earlier. Gucci fell by 26%, Saint Laurent dropped by around a tenth, while in contrast Bottega Veneta showed slight growth. In the third quarter of 2025, Kering’s revenues reached approximately €3.4 billion, representing a decline of around 10% on a reported basis and 5% on a comparable basis. Gucci generated about €1.3 billion in this period and was still nearly one-fifth in the red. However, the pace of decline slowed visibly compared with the first half. At the same time, the group is strengthening its own store network, cutting back wholesale and preparing a product and creative reboot of Gucci, which makes it a riskier but potentially rewarding bet for investors if it manages to restore demand and margins without further weakening the brand’s position.[1]

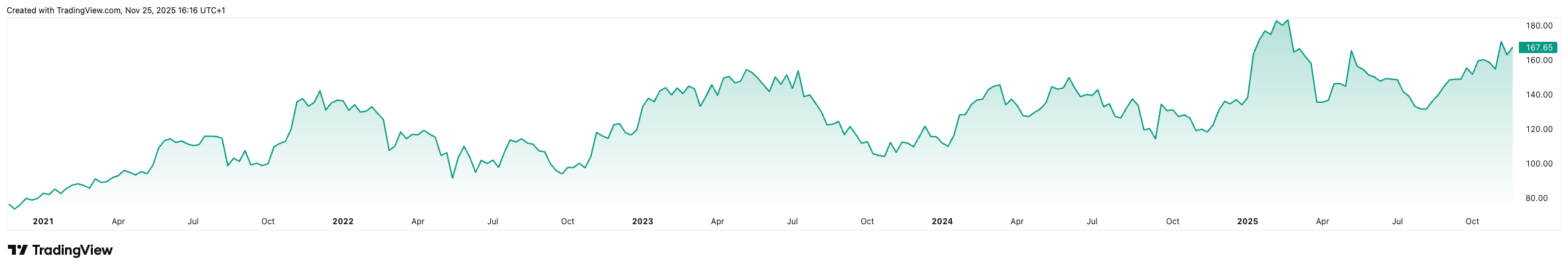

Kering shares, primarily traded on Euronext Paris under the ticker KER, have bounced off their lows after the earlier slump in 2025 and by late November are roughly one-third higher than at the beginning of the year, indicating a partial return of investor confidence.*[7]

Kering share price performance over the last 5 years. (Source: tradingview.com)

Estée Lauder: A resilient strategy built on cosmetics

In the run-up to the Christmas shopping season, the company traditionally relies on gift sets and bundles that increase perceived value without putting dramatic pressure on margins and gradually seeks to benefit from a recovery in demand for more affordable luxury goods, especially in Asia. In terms of perceived market risk, Estée Lauder thus appears as a company in a transition phase, combining a fading sales decline with the first signs of renewed growth and improving profitability.

While fashion and leather goods have weakened, cosmetics have had a highly volatile year, and Estée Lauder is responding with a major restructuring. For the 2025 fiscal year (ending 30 June 2025), the group generated net sales of approximately $14.3 billion, an 8% drop compared with the previous year, but at the same time improved its gross margin to 74% thanks to cost savings and stricter pricing discipline. In the first quarter of its 2026 fiscal year (the period from 1 July to 30 September 2025), sales were already back to growth, up 4% year-on-year to approximately $3.48 billion, with organic growth of 3% and the biggest driver being the fragrances segment, which gained around 13–14%.

Estée Lauder shares, traded on the New York Stock Exchange under the ticker EL, have gradually rebounded from levels just above $70 after a sharp drop during 2025 and by late November are trading around $90–95 per share, representing a noticeable but still only partial recovery compared with past highs.*[8]

Estée Lauder share price performance over the last 5 years. (Source: tradingview.com)

New rules of Black Friday in luxury

Developments in 2025 show that extreme exclusivity is becoming a less effective strategy when customers focus on value. Brands that can communicate prestige without excessive closed-off positioning achieve better results. Black Friday is thus turning into a stage for testing the ability to find the balance between accessibility and exceptionality.

*Past performance is not a guarantee of future results.

[1] Forward-looking statements are based on assumptions and current expectations that may be inaccurate, or on the current economic environment, which may change. Such statements are not a guarantee of future performance. They involve risks and other uncertainties that are difficult to predict. Actual results may differ materially from those expressed or implied in any forward-looking statements.

[1] https://www.lvmh.com/en/publications/amelioration-des-tendances-au-troisieme-trimestre-

[2] https://www.thefashionlaw.com/lvmh-returns-to-growth-posting-e58-1b-in-sales-for-9-months-of-2025

[3] https://assets-finance.hermes.com/s3fs-public/node/pdf_file/2025-10/1761060884/hermes_20251022_q3revenue_en.pdf

[4] https://www.worldfootwear.com/news/hermes-posts-solid-nine-month-performance/11005.html

[5] https://www.thefashionlaw.com/hermes-9-month-revenue-hits-13-8b-powered-by-leather-u-s-momentum

[6] https://aidi.org/richemont-jewelry-sales-q2-2025/

[7] https://www.gainify.io/blog/top-publicly-traded-luxury-brands

[8] https://www.morningstar.com/company-reports/1324243-sharp-focus-on-innovation-and-marketing-positions-estee-lauder-well-to-tap-premium-beauty-demands