Warning on risks: Financial contracts for difference are complex instruments and are associated with a high risk of rapid financial losses due to leverage. On 76.44% of retail investor accounts, financial losses occur when trading financial contracts for difference with this provider. You should consider whether you understand how financial contracts for difference work, and whether you can afford to take the high risk of suffering financial losses. Please read the Risk Disclosures.

Electronic Arts to Go Private in Largest Buyout of This Kind

About the Company

Electronic Arts has grown into one of the largest players in interactive entertainment, generating billions in annual revenues. Headquartered in Redwood City, USA, the company has built its position on a strong portfolio of premium brands covering various genres, with its strongest division remaining EA Sports, contributing to a substantial share of revenue. It covers titles such as FC (formerly FIFA), Madden NFL, and College Football. These games are released annually and are supplemented with regular content updates that keep the player base active throughout the year. Beyond sports, EA’s portfolio includes major franchises such as Battlefield, Apex Legends, The Sims, Mass Effect, and Dragon Age, distributed across console, PC, and mobile platforms. The company operates through major subsidiaries including DICE, Respawn Entertainment, BioWare, and Criterion Games, and employs approximately 14,500 people worldwide.

EA Goes Private for a Record $55 Billion

The deal, which will be recorded as the largest private buyout of a company, values Electronic Arts at $210 per share—about 25% higher than originally expected. The transaction is backed by Saudi Arabia’s sovereign wealth fund PIF, which already holds nearly a 10% stake in EA, along with investment firm Silver Lake and Affinity Partners. Together, investors will contribute $36 billion in equity, with an additional $20 billion financed through a loan from JPMorgan Chase. The agreement also includes a 45-day period during which other bidders may submit competing offers. If nothing changes, the acquisition is expected to close in the first quarter of fiscal year 2027, around June 2026.

The buyout is largely debt-financed, a common approach, though its scale is unprecedented. While it would be “only” the second-largest transaction in the gaming industry after Microsoft’s $69 billion acquisition of Activision Blizzard in 2023, in terms of financing structure it will be the largest leveraged buyout in history. The previous record was the $32 billion purchase of energy company TXU in 2007. [1][2]

An Emerging Trend in the Video Game Industry?

EA is becoming part of a broader wave of consolidation that began with Microsoft’s acquisition of Activision Blizzard in 2023, bringing private equity funds and sovereign wealth funds such as Saudi Arabia’s PIF into the spotlight. The trend is clear: pressure for scale and stable revenues is increasing, mid-sized studios are losing ground, and room for independence is shrinking. In the coming years, we can therefore expect further mergers, reassessments of business models, and a strengthening influence of major investors who will set the rules. [1]

How Did Industry Stocks React?

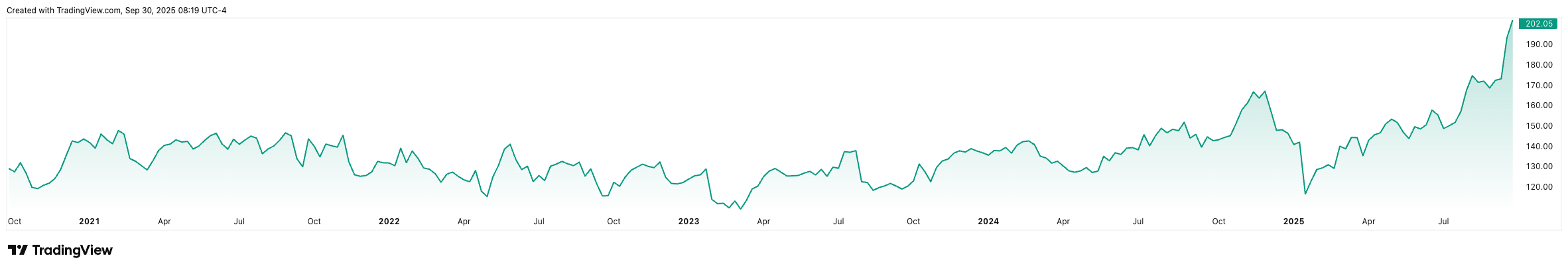

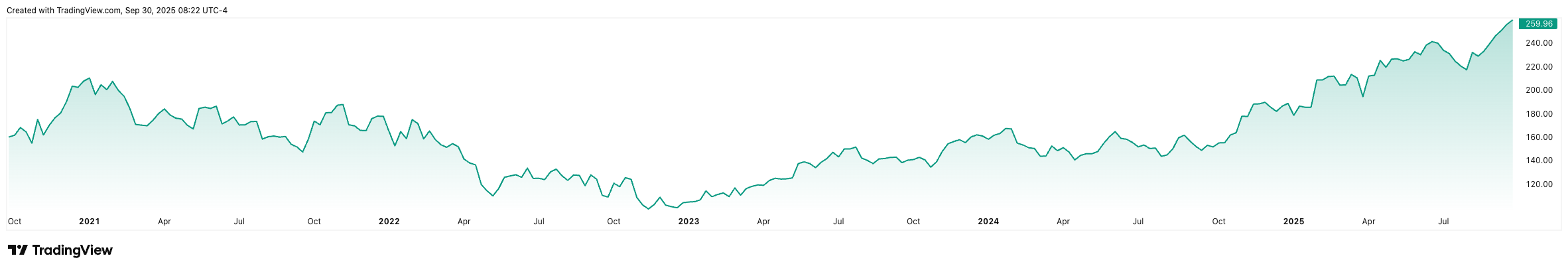

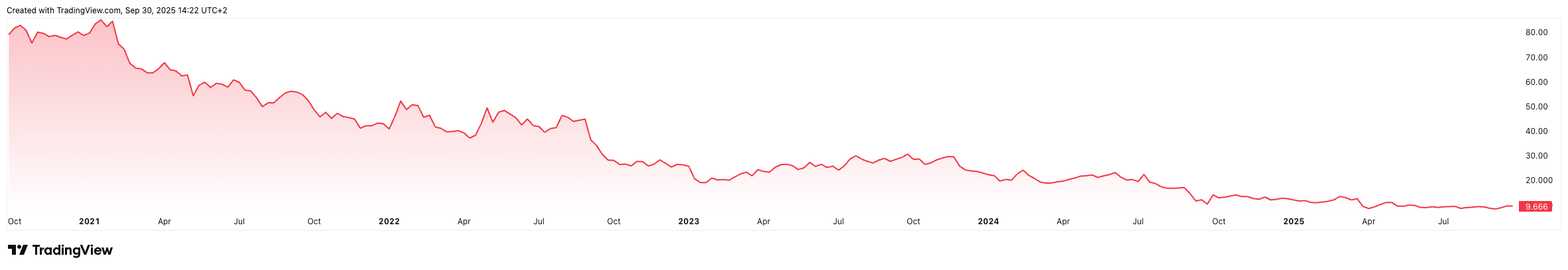

This announcement is not only a turning point for EA but may also lead other gaming companies to reconsider their strategies in an industry currently navigating uncertain waters after a pandemic-era boom followed by stagnation. In addition to a significant rise in EA’s stock price, shares of Take-Two Interactive—best known for franchises such as Grand Theft Auto and NBA 2K—also responded positively. Take-Two remains one of the few independent publicly traded companies, making it a logical target for investors. By contrast, Ubisoft tells the opposite story: its stock has lost about 87% of its value over the past five years, and in fiscal year 2025 (period ending March 2025) the company reported a loss of €158.7 million ($186.4 million).[3][4]

Electronic Arts stock performance over the last 5 years. (Source: tradingview.com)*

Take-Two Interactive stock performance over the past 5 years. (Source: tradingview.com)*

Ubisoft stock performance over the past 5 years. (Source: tradingview.com)*

Financial results

In the first quarter of fiscal year 2026, EA reported revenues of $1.67 billion, a year-over-year increase of only 0.66%. The company exceeded its own expectations with net bookings (the sum of digital sales, subscriptions, and microtransactions), which amounted to $1.3 billion. However, net income fell by 28% to $201 million compared to $280 million in the same period last year. The biggest support continues to come from live services (online functions and in-game support) and sports franchises, which generate the majority of revenues and continue steady growth, while the full game segment remains weaker. For fiscal year 2025 (period ending March 2025), EA achieved revenues of $7.47 billion and net income of $1.04 billion, confirming its strong financial foundation but also suggesting that future growth will increasingly depend on recurring revenues and the ability to keep players engaged long term.[5]

Conclusion

What does EA’s transition to private ownership mean for investors? Current shareholders benefit from a high premium on the buyout, but for new investors the possibility of entering the company ends. For the gaming industry as a whole, however, it signals growing interest from large capital funds, which may accelerate further consolidation and increase pressure on independent studios. Potential opportunities will increasingly concentrate on smaller publicly traded companies or on funds capable of participating in similar large-scale deals. [2]

* Past performance is not a guarantee of future results.

[1,2] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which is subject to change. Such statements are not a guarantee of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.

[1] https://www.investing.com/news/stock-market-news/electronic-arts-to-go-private-in-55-billion-deal-with-pif-silver-lake-4260602

[2] https://www.cnbc.com/2025/09/29/ea-shareholders-will-get-210-per-share-in-deal-to-take-company-private.html

[3] https://www.investing.com/analysis/electronic-arts-investors-face-final-upside-before-company-exits-public-markets-200667683

[4] https://www.euronews.com/business/2025/09/30/how-could-eas-go-private-deal-impact-the-video-game-industry

[5] https://ir.ea.com/financials/quarterly-results/default.aspx