Warning on risks: Financial contracts for difference are complex instruments and are associated with a high risk of rapid financial losses due to leverage. On 76.44% of retail investor accounts, financial losses occur when trading financial contracts for difference with this provider. You should consider whether you understand how financial contracts for difference work, and whether you can afford to take the high risk of suffering financial losses. Please read the Risk Disclosures.

AMD is Gaining Upper Hand: Why Nvidia Is No Longer the Only AI Choice

Cheaper Product Alternative

A key aspect of AMD’s rising popularity versus Nvidia is the ability to deliver comparable performance at lower deployment cost. For large-scale operations, this is a major advantage. AMD’s latest Instinct series chips, including MI355 and MI355X, are built specifically for AI needs. This makes sense especially when considering total cost of ownership. Data-center operators look not only at maximum performance, but at cost per performance, power consumption, scalability, availability, and software support. Here AMD starts to make economic sense.[1]

OpenAI and Oracle as Proof That AMD is Serious

Nvidia’s historic advantage has been software and ecosystem. AMD is accelerating here too. According to vendor documentation, the ROCm 7 platform delivers significant acceleration over ROCm 6. This lowers barriers for companies seeking to diversify suppliers and adopt a more open approach. The strongest proof of AMD’s positive momentum is its multi-year agreement with OpenAI, detailed in our previous analysis. It includes up to 6 GW of compute capacity on AMD accelerators for next-generation infrastructure. Oracle is also preparing the first publicly available high-capacity “Helios” system, combining Instinct MI450 accelerators and EPYC server processors, with an initial deployment of 50,000 units in Q3 2026. Additional expansions come from providers such as Vultr and DigitalOcean and collaborations with Cisco, IBM, Cohere, and the U.S. Department of Energy; the Lux project is planned as the first “AI factory” in the United States built on Instinct MI355X.[2][3]

Nvidia Remains the Leader, at Least for Now...

The most accurate comparison between AMD and Nvidia is currently in consumer graphics processing units (GPUs). According to the latest publicly available Jon Peddie Research data for Q2 2025, Nvidia holds roughly 94 % market share and AMD 6 %. JPR has not yet published Q3 2025 numbers in public sources. In data-center accelerators, there are no public unit-level sales across the market, so revenue share estimates are used. TrendForce estimates Nvidia’s share at about 70 % of the AI data-center chip market in 2025, with the remainder divided among AMD and other manufacturers.[4]

Therefore, while Nvidia is almost a monopoly in consumer graphics, the fast-growing AI-infrastructure segment is more dynamic. AMD is gaining ground, and its share is best tracked through reported financials and confirmed deployments with major customers.

Hard Facts from the Results: The Company's Performance in Numbers

AMD achieved record revenue of $9.25 billion in Q3 FY2025, up 36% year-over-year and beating the market consensus of $8.7 billion. Net income was $1.24 billion, up 61% from the same period last year, and adjusted earnings per share (EPS) came in at $1.20, up 30%. At the same time, the company reported its highest all-time free cash flow of $1.56 billion. The results do not include deliveries of Instinct MI308 accelerators to China due to U.S. export restrictions, so adjusted demand looks even stronger.[5]

The Outlook is More Than Optimistic

According to the October 2025 consensus of Visible Alpha analysts, AMD's revenue should grow from $33 billion expected this year to about $42 billion in 2026 and exceed $50 billion in 2027. Several investment banks, such as Morgan Stanley, state that AI accelerators alone could bring in around $20 billion in 2027, pushing the product mix towards higher margins. Even more important is EPS: Bank of America forecasts about $3.90 per share and up to $18.00 by the end of the decade, which corresponds to an average annual growth of about 40%.*[6]

At first glance, AMD appears overvalued, with the last-12-month price-to-earnings (P/E) ratio at 128. But if the company meets the projected 2026 EPS, the multiplier would fall to 42; with EPS of $9.00 in 2027 it compresses to 27; and at $18.00 in 2030 it is about 13.5. The bull case assumes the accelerator market grows faster than a single supplier can serve.[7][8]

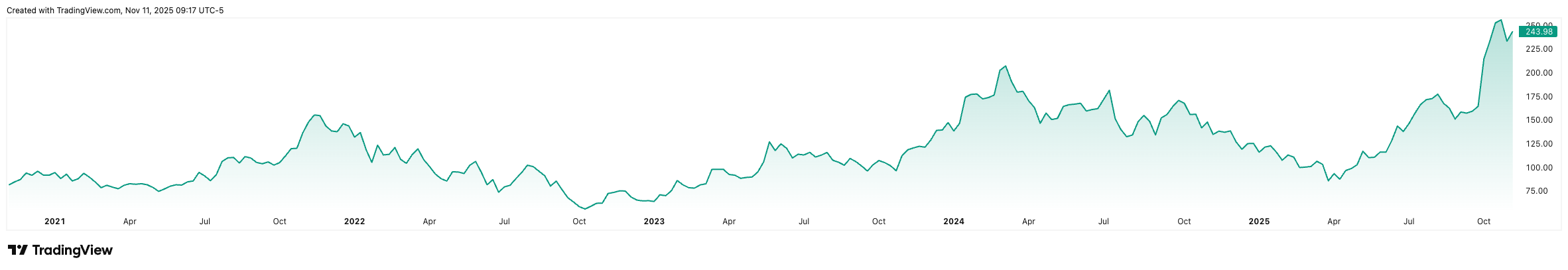

AMD stock performance over the last 5 years. (Source: tradingview.com)*

Conclusion

AMD is no longer an outsider that reacts to competitors' actions. It is a company with its own strategy, improving software and products that make economic sense for operators in artificial intelligence computing tasks. If you are looking for a company today that has the potential to cut a significant part of the fastest growing segment of the technology world, AMD is one of the most interesting titles. It is the first real competitor that can not only second Nvidia, but also convince customers with numbers.

* Past performance is not a guarantee of future results.

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which is subject to change. Such statements are not a guarantee of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.

[1] https://www.networkworld.com/article/4006570/amd-steps-up-ai-competition-with-instinct-mi350-chips-rack-scale-platform.html

[2] https://ir.amd.com/news-events/press-releases/detail/1260/amd-and-openai-announce-strategic-partnership-to-deploy-6-gigawatts-of-amd-gpus

[3] https://www.oracle.com/europe/news/announcement/ai-world-oracle-and-amd-expand-partnership-to-help-customers-achieve-next-generation-ai-scale-2025-10-14

[4] https://www.jonpeddie.com/news/q125-pc-graphics-add-in-board-shipments-increased-8-5-from-last-quarter-due-to-nvidias-blackwell-ramping-up

[5] https://ir.amd.com/news-events/press-releases/detail/1265/amd-reports-third-quarter-2025-financial-results

[6] https://www.spglobal.com/market-intelligence/en/news-insights/research/2025/10/analysts-lift-amds-long-term-revenue-forecasts-after-openai-deal

[7] https://www.benzinga.com/markets/tech/25/11/48766626/amd-stock-analysis-analyst-day-2025-earnings-ai-gpu-nvidia-chips-bank-of-america

[8] https://finance.yahoo.com/news/amd-gains-analyst-praise-gpu-172433163.html