Warning on risks: Financial contracts for difference are complex instruments and are associated with a high risk of rapid financial losses due to leverage. On 76.44% of retail investor accounts, financial losses occur when trading financial contracts for difference with this provider. You should consider whether you understand how financial contracts for difference work, and whether you can afford to take the high risk of suffering financial losses. Please read the Risk Disclosures.

AMD and OpenAI: A Partnership That Could Rewrite the History of the AI Chip Market

About the Company

Advanced Micro Devices (AMD) is an American technology company headquartered in Santa Clara, California. Founded in 1969, it long operated as Intel’s “little brother” in the processor market. Over the past decade, however, AMD has undergone a dramatic transformation. Under the leadership of CEO Lisa Su, the company has broken through technical barriers, gained market share in servers, and built a reputation as an innovative player. Today, AMD is Nvidia’s main competitor in AI chips, providing computing solutions for the world’s largest technology firms. Its clients include seven of the ten global AI leaders.

The Deal That Moved the Markets

AMD announced a multi-year partnership with OpenAI under which it will supply up to 6 gigawatts of computing power to build AI infrastructure. The first deployment will begin in the second half of 2026, when OpenAI will use 1 gigawatt of power through the new generation of Instinct MI450 chips.

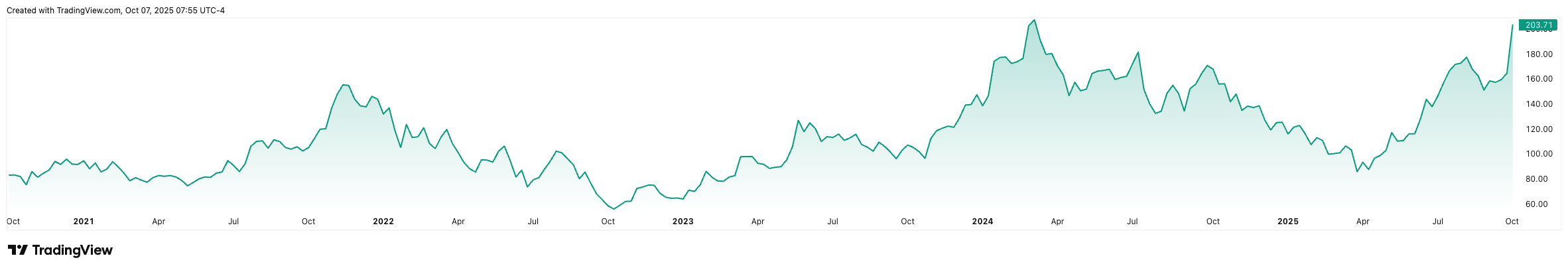

The deal also includes an innovative warrant structure: OpenAI has received the right to purchase 160 million AMD shares for $1 each, representing approximately 10% of the company. The market reacted instantly — AMD’s stock closed the trading session at $203.71, marking a 23.71% increase, the largest single-day jump in more than a year.* This pushed the company’s market capitalization up by $63.36 billion to a total of $330.6 billion. According to AMD CFO Jean Hu, the partnership is expected to generate tens of billions of dollars in revenue. The agreement is structured to accelerate AMD’s expansion in the AI sector significantly.

AMD stock performance over the past 5 years. (Source: tradingview.com)*

So Far, the AI Chip Market Has Been Dominated by Nvidia

Currently, Nvidia controls roughly 85 to 92% of the AI accelerator market, while AMD holds an estimated 8–14%. The partnership with OpenAI represents AMD’s biggest breakthrough in this area and confirms it as a viable alternative in a market where demand far exceeds supply. This collaboration goes beyond a typical chip supply deal. The companies will jointly optimize their planning, covering multiple future chip generations. The partnership fits into OpenAI’s broader strategy under the $500 billion Stargate megaproject, which aims to build massive AI data centres across the United States.

OpenAI President Greg Brockman has openly described the “shortage of compute” as the company’s biggest operational challenge. The AMD deal complements OpenAI’s existing $100 billion collaboration with Nvidia. OpenAI plans to continue increasing its purchases from Nvidia while diversifying its supply chains at the same time.

Potential Collaboration with Intel

The AMD–OpenAI deal is not the only news that has reverberated through the tech industry. According to Tom’s Hardware and Semafor, the company is considering using Intel Foundry Services (IFS) to manufacture part of its chips. Currently, nearly all AMD chips are produced by the Taiwanese giant TSMC. Although AMD has not officially commented on these talks, available information indicates early-stage discussions that could lead to an unprecedented collaboration between long-time rivals. The reason is pragmatic: manufacturing capacity is currently one of the biggest constraints on AI market growth. If the deal goes through, it could significantly accelerate the production of MI450 chips and future generations, giving AMD another competitive edge.

Financial Results

In the second quarter of 2025, AMD reported very strong non-GAAP results, reflecting its operational strength excluding one-off items. Revenue reached a record $7.7 billion, a 32% year-over-year increase. However, net income fell 31% year-over-year to $781 million. Gross margin came in at 43%, while adjusted operating income reached $897 million. These results were impacted by U.S. export restrictions on MI308 chips, which led to inventory-related costs of roughly $800 million. Without these costs, AMD stated that its adjusted gross margin would have reached 54%.

Conclusion

With this deal, AMD has gained not only a significant business advantage but also a strategic position that allows it to help shape the technological standard of the next era. For investors, it is important to view this not merely as a short-term stock price catalyst, but as the beginning of a deeper shift in the company’s role within the AI ecosystem. If AMD can scale up production quickly, deliver top-tier performance, and maintain financial discipline, it can secure a lasting share of one of the most lucrative technology markets of the coming decade. But if it loses momentum, competitors will seize the opportunity. In the coming quarters, the market will evaluate not just AMD’s financial results but also its ability to handle its new strategic role. [1]

* Past performance is not a guarantee of future results.

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which is subject to change. Such statements are not a guarantee of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.

https://finance.yahoo.com/news/surprising-ai-deal-puts-amd-013700122.html

https://www.marketwatch.com/story/amds-stock-soars-25-heres-why-openai-wants-a-stake-in-it-7958979b